CoreLogic: Mortgage Delinquency Rate Hovers Near Record Low

CoreLogic, Irvine, Calif., said mortgage delinquencies fell in February from January but rose slightly from a year ago.

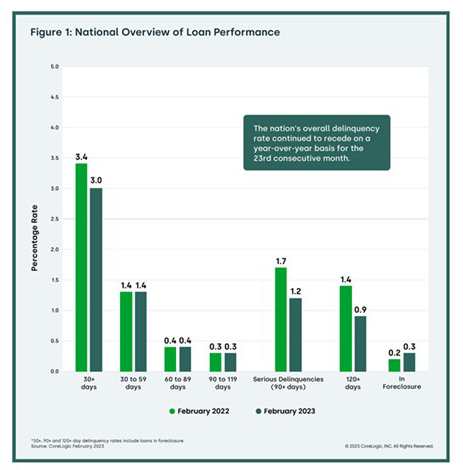

The company’s monthly Loan Performance Insights Report said 3% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure) in February, representing an 0.4 percentage point decrease from 3.4% a year ago and an 0.2 percentage point increase from January.

Other report findings:

• Early-Stage Delinquencies (30 to 59 days past due): 1.4%, unchanged from a year ago and up from 1.3% in January.

• Adverse Delinquency (60 to 89 days past due): 0.4%, unchanged from February 2022.

• Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.2%, down from 1.7% in February 2022 and a high of 4.3% in August 2020.

• Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, up from 0.2% in February 2022.

• Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.7%, down from 0.8% in February 2022.

Molly Boesel, principal economist with CoreLogic, noted the national mortgage delinquency rate has barely changed year over year since spring 2022, indicating a fairly stable economy in which most borrowers are able to pay their mortgages on time. Similarly, the U.S. foreclosure rate has held steady at 0.3% for a year.

“Despite a small monthly increase in the share of mortgage payments that were one month late in February, early-stage delinquencies remained unchanged year over year,” Boesel said. “February’s early-stage delinquency rate was historically low and primarily driven by a strong job market. However, the possibility of a recession that would raise the U.S. unemployment rate could slightly erode the current strong mortgage performance situation in the coming months.”

Boesel added while the unemployment rate remained near a pre-pandemic low in March, it is possible that mortgage delinquency rates could begin to creep up later this year, as the impact of recent job losses begin to affect the numbers several months later.

The report said no state posted an annual increase in overall delinquency rates in February. States with the largest declines were New York and West Virginia (both down by 0.9 percentage points). Other states’ annual delinquency rates dropped between 0.8 and 0.1 percentage points.

CoreLogic said 18 U.S. metro areas posted an increase in overall delinquency rates. The top two areas for mortgage delinquency gains year over year were Cape Coral-Fort Myers, Florida and Punta Gorda, Fla. (both up by 1.7 percentage points).

All but four U.S. metro areas posted at least a small annual decrease in serious delinquency rates (defined as 90 days or more late on a mortgage payment) in February. The metros that saw serious delinquencies increase were Cape Coral-Fort Myers; and Punta, Gorda Fla. (both up by 1.3 percentage points). North Port-Sarasota-Bradenton, Fla.; and Bloomsburg-Berwick, Pa. (up by 0.1 percentage point).