MBA’s Mike Fratantoni, Industry Execs Share 2024 Predictions, Advice

(Image via Snapdocs Webinar)

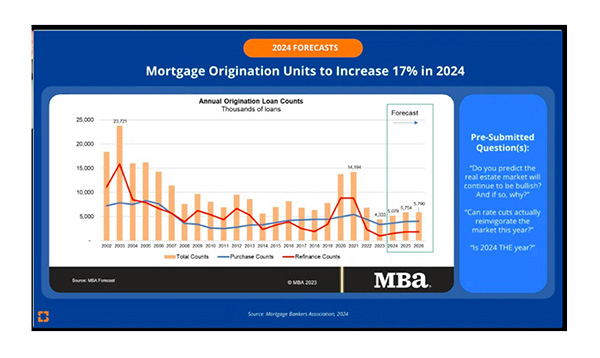

Mike Fratantoni, MBA Chief Economist and Senior Vice President of Research and Industry Technology, continued to forecast 2024 growth in both purchases and refinances while speaking on a Jan. 16 webinar panel hosted by Snapdocs, Covina, Calif.

The webinar, titled “2024 Lender Strategies: What (Another) Unprecedented Year in Mortgage Taught Us,” reviewed some of the twists of the 2023 market and provided a look at some predicted 2024 trends.

Overall, Fratantoni anticipated a 17% increase in mortgage origination units in 2024 (with further increases in 2025 and 2026), and a 22% increase in mortgage origination dollar volume.

Snapdocs CEO Michael Sachdev, moderating the panel, inquired about the logic of an expected increase in cash-out refinances, noting that individuals may be giving up more favorable interest rates in the process.

“The fact that you have more than a trillion outstanding in credit card balances, your typical auto loan now is $40,000 on a new car, student debt has restarted again–you have a lot of households that are under some stress,” Fratantoni said. “And if they can tap into their home equity–and they’ve got a lot of it–to try to manage some of that stress, I think you’re going to see opportunities for debt consolidation and cash-out refinance these next couple of years.”

The demographics are going to be strongly supportive of the purchase market for the next five or so years, Fratantoni said. The U.S. is generating more households per year, and they need to live somewhere–whether that’s via homebuying or renting landlords’ properties.

Millennials are coming, Fratantoni said. “We think this is going to be a strongly supportive force for the housing market, medium-term.”

Home price growth will continue, but more slowly, in the 3-4% range per year, he predicted.

Rates are expected to drift down over the course of 2024, Fratantoni said. Also, constraints on the inventory side will improve. That will include some improvements to the so-called “lock-in effect,” in which homeowners are loathe to sell and lose their existing low interest rates.

However, Fratantoni said, various life events still spark moves. As Sachdev put it: “I think that might be the takeaway of the day–which is that life is more important than mortgage rates.”

Supreme Lending SVP of National Sales Candice McNaught and Priority Title & Escrow CEO Joseph LaMontagne talked exiting the tumultuous 2023 environment and heading into a still-challenging 2024. In terms of strategies, each provided some takeaways.

McNaught pointed to supporting and retaining top talent and investing in their education and marketing. She also noted the importance of digital strategies and adjusting to a changing market.

LaMontagne also discussed investing in good technology, and his firm’s drive to further build out product offerings and expand its customer base.

Efficiency and effective use of technology will be focuses and challenges moving forward, the panelists noted, among others.

As another piece of advice, Fratantoni urged those listening to “know their business models” in the current environment.

“It seems like the companies that I’ve seen who are most successful have a strategy. Everyone in the organization knows it and are driving toward that,” Fratantoni observed. “They choose their tools, and they choose their partners very consciously knowing what it is they’re trying to do.”