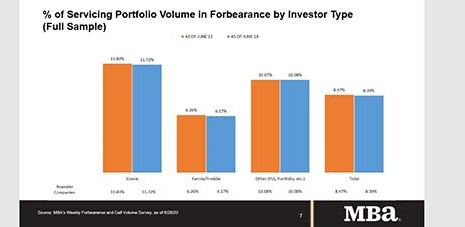

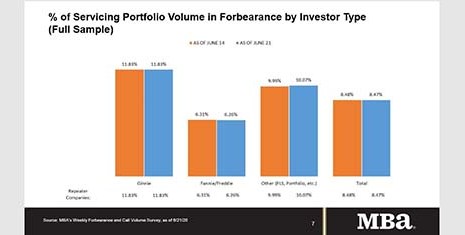

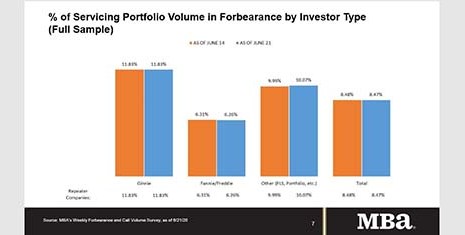

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

Tag: Mike Fratantoni

MISMO Certifies First Two Remote Online Notary Products

MISMO®, the mortgage industry standards organization, today announced eNotaryLog and Notarize are the first two companies to complete MISMO’s new Remote Online Notarization certification program. RON certification provides assurance that products fulfill the requirements of the MISMO Remote Online Notary Standards.

MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

MISMO Certifies First Two Remote Online Notary Products

MISMO®, the mortgage industry standards organization, today announced eNotaryLog and Notarize are the first two companies to complete MISMO’s new Remote Online Notarization certification program. RON certification provides assurance that products fulfill the requirements of the MISMO Remote Online Notary Standards.

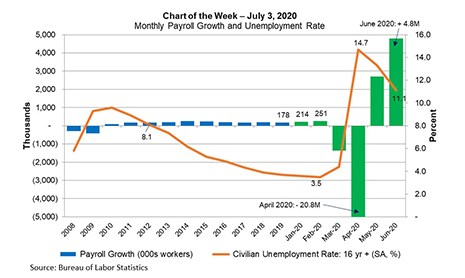

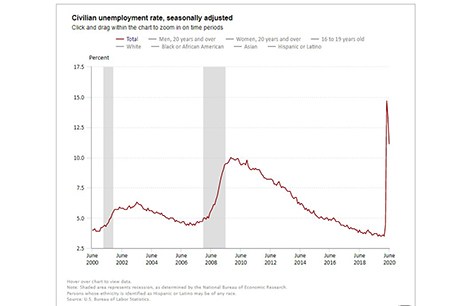

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

The economy added a record 4.8 million jobs to nonfarm payrolls in June, bringing the cumulative increase in May and June to one-third of the sharp decreases in March and April. Similarly, the June unemployment rate, at 11.1%, was down 3.6% from its high in April, and labor force participation jumped by 0.7% to 61.5% (1.9% below its pre-coronavirus level in February). However, we are not yet out of the woods.

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

The economy added a record 4.8 million jobs to nonfarm payrolls in June, bringing the cumulative increase in May and June to one-third of the sharp decreases in March and April. Similarly, the June unemployment rate, at 11.1%, was down 3.6% from its high in April, and labor force participation jumped by 0.7% to 61.5% (1.9% below its pre-coronavirus level in February). However, we are not yet out of the woods.

June Jobs Up Nearly 5 Million; Unemployment Rate Drops; New Claims at 1.4 Million

The Bureau of Labor Statistics reported total nonfarm payroll employment jumped by 4.8 million in June, as easing of coronavirus restrictions brought back more workers who had been laid off earlier this spring.

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.