The Federal Open Market Committee yesterday acknowledged a fast-heating U.S. economy, but said it did not expect increases in the federal funds rate before 2023.

Tag: Mike Fratantoni

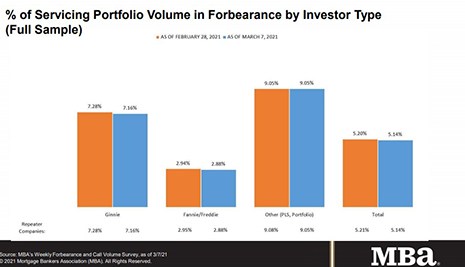

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.14%

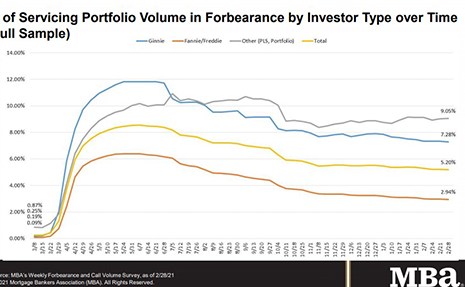

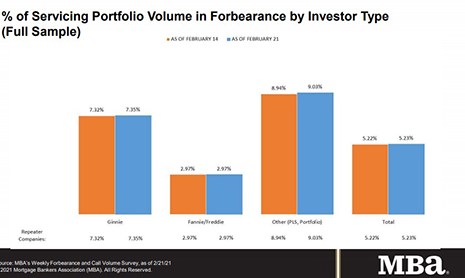

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 5.14% of servicers’ portfolio volume as of March 7 from 5.20% the prior week. MBA estimates 2.6 million homeowners are in forbearance plans.

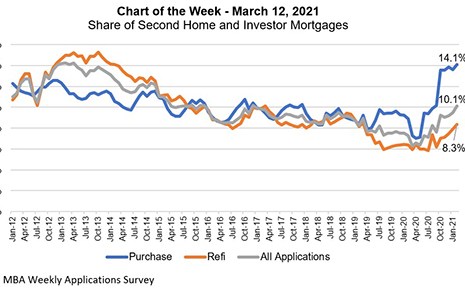

MBA Chart of the Week, Mar. 15, 2021: Share of Second Home & Investor Mortgages

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a second home or investment property.

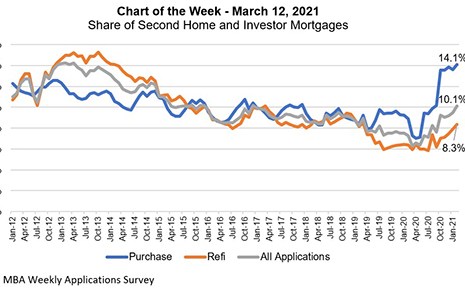

MBA Chart of the Week, Mar. 15, 2021: Share of Second Home & Investor Mortgages

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a second home or investment property.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.20%

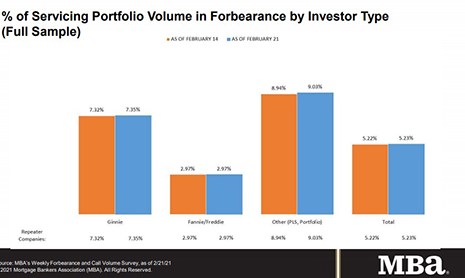

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.20% of servicers’ portfolio volume as of February 28 from 5.23% the previous week. MBA estimates 2.6 million homeowners are in forbearance plans.

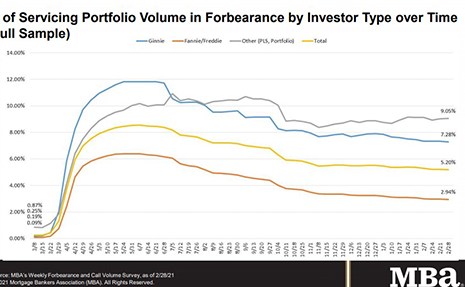

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.20%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.20% of servicers’ portfolio volume as of February 28 from 5.23% the previous week. MBA estimates 2.6 million homeowners are in forbearance plans.

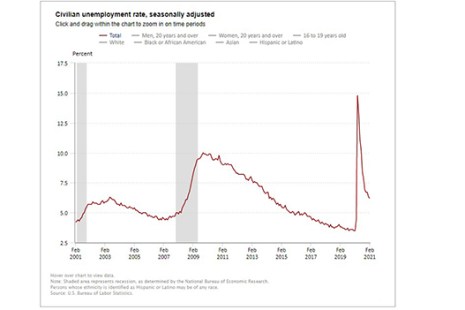

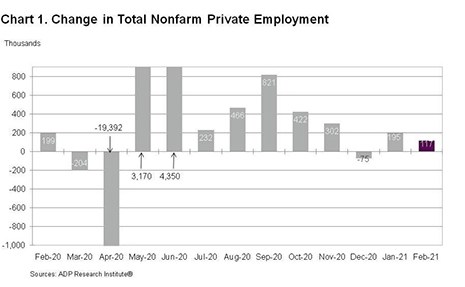

February Sees Strong 379K Job Gain

Employers added an impressive 379,000 jobs last month, the Bureau of Labor Statistics reported Friday, welcome news for an economy still struggling with the loss of millions of jobs resulting from the coronavirus pandemic.

ADP: February Private-Sector Employment Up 117,000

Ahead of this Friday’s employment report from the Bureau of Labor Statistics and this morning’s weekly initial claims for unemployment insurance report from the Labor Department, ADP, Roseland, N.J., said private-sector employment increased by 117,000 jobs from January to February.

MBA: Share of Mortgage Loans in Forbearance Inches Up

For the first time in five weeks, loans in forbearance increased, albeit ever so slightly, the Mortgage Bankers Association reported yesterday.

MBA: Share of Mortgage Loans in Forbearance Inches Up

For the first time in five weeks, loans in forbearance increased, albeit ever so slightly, the Mortgage Bankers Association reported yesterday.