Good morning! While Congress continues to work out a compromise on infrastructure legislation, eyes shift to Foggy Bottom, where the Federal Open Market Committee meets this week to figure out if inflation has become a problem.

Tag: Mike Fratantoni

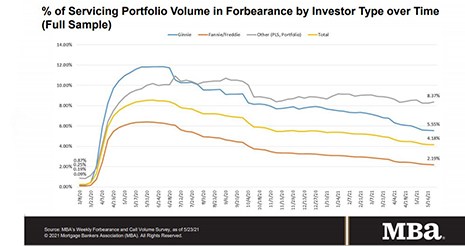

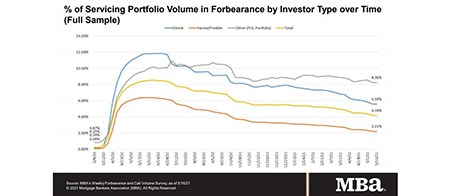

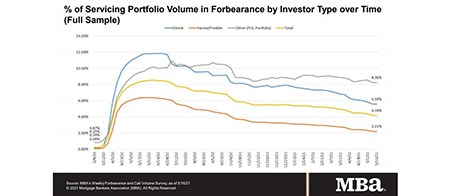

Share of Mortgage Loans in Forbearance Dips Slightly to 4.16%

The share of loans in forbearance haven’t moved much lately–but for the past 14 weeks, they’ve been moving down, the Mortgage Bankers said Monday.

Share of Mortgage Loans in Forbearance Dips Slightly to 4.16%

The share of loans in forbearance haven’t moved much lately–but for the past 14 weeks, they’ve been moving down, the Mortgage Bankers said Monday.

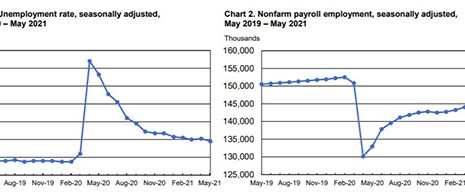

May Employment Up 559,000; Unemployment Rate Drops to 5.8%

Total nonfarm payroll employment rose by 559,000 in May, the Bureau of Labor Statistics reported Friday—up substantially from May’s tepid numbers but still below consensus expectations, as hiring slowly recovers from the coronavirus pandemic.

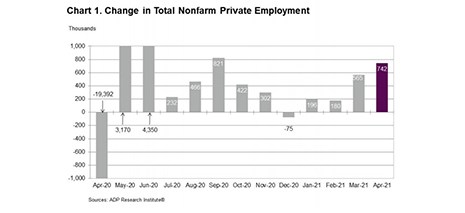

ADP: Private Sector Adds 742,000 April Jobs

Ahead of this morning’s initial claims report and Friday’s employment report, ADP, Roseland, N.J., said private-sector employment increased by 742,000 jobs from March to April.

MBA: Share of Mortgage Loans in Forbearance Falls 13th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 1 basis point to 4.18% of servicers’ portfolio volume as of May 23 from 4.19% the prior week–the 13th straight weekly decline. MBA estimates 2.1 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Falls 13th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 1 basis point to 4.18% of servicers’ portfolio volume as of May 23 from 4.19% the prior week–the 13th straight weekly decline. MBA estimates 2.1 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases to 4.19%

Mortgage loans in forbearance fell for the 12th consecutive week, the Mortgage Bankers Association reported Monday.

MBA: Share of Mortgage Loans in Forbearance Decreases to 4.19%

Mortgage loans in forbearance fell for the 12th consecutive week, the Mortgage Bankers Association reported Monday.

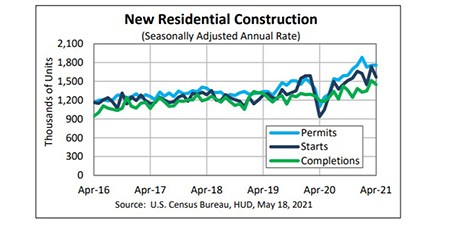

Supply Issues Hold Back April Housing Starts

Supply constraints continue to prevent a sizzling housing market from turning white-hot, with April housing starts falling by nearly 10 percent, HUD and the Census Bureau reported Tuesday.