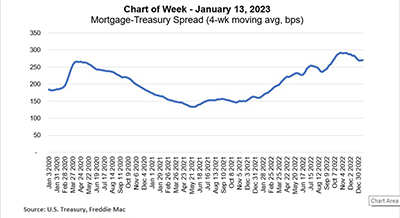

This week’s MBA Chart of the Week looks at the spread of mortgage rates relative to Treasury yields. This has been one of the more puzzling aspects of the current environment and a contributor to the rapid rise in mortgage rates over the past year.

Tag: Mike Fratantoni

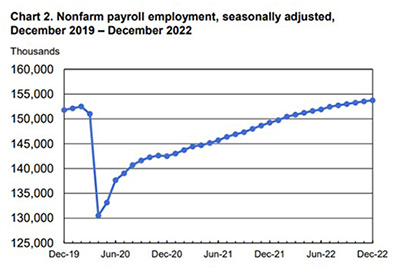

2022 Jobs Finish on Strong Note

Although nonfarm payroll employment slowed toward the end of the year, it finished on a strong, steady pace, the Bureau of Labor Statistics reported Friday.

MBA Chart of the Week: New, Existing Home Sales

We are forecasting a weak start to 2023 for the housing market. Driven by a recession in the first half of the year and a continuation of the trends outlined above, we expect a 13% drop in existing home sales and a 4% decrease in new home sales for 2023, following 16% decreases in both segments in 2022.

MBA Chart of the Week: New, Existing Home Sales

We are forecasting a weak start to 2023 for the housing market. Driven by a recession in the first half of the year and a continuation of the trends outlined above, we expect a 13% drop in existing home sales and a 4% decrease in new home sales for 2023, following 16% decreases in both segments in 2022.

MBA Weekly Survey Dec. 21, 2022: Falling Rates Boost Refis for 2nd Straight Week

The lowest interest rates since September spurred an uptick in refinance activity for the second straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending December 16.

MBA Weekly Survey Dec. 21, 2022: Falling Rates Boost Refis for 2nd Straight Week

The lowest interest rates since September spurred an uptick in refinance activity for the second straight week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending December 16.

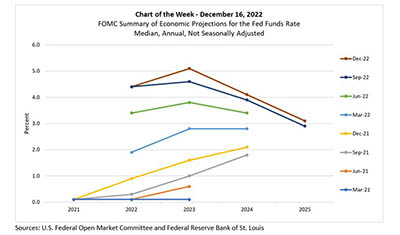

MBA Chart of the Week Dec. 16, 2022: Federal Funds Rate Projections

In an effort to increase transparency after the Great Recession, one of the Federal Open Market Committee communication initiatives under Chairman Ben Bernanke was to publish individual members’ assessments of the economy in the Summary of Economic Projections. In this week’s MBA Chart of the Week, we track changes in policymakers’ quarterly published SEP forecasts of the federal funds rate over the past eight quarters.

Fed Slows Pace of Rate Hikes, But Hints at More

In its final policy meeting of an eventful year, the Federal Open Market Committee on Wednesday raised the federal funds rate for the seventh straight meeting, but by 50 basis points instead of 75 basis points, as it had for the past four times.

Fed Slows Pace of Rate Hikes, But Hints at More

In its final policy meeting of an eventful year, the Federal Open Market Committee on Wednesday raised the federal funds rate for the seventh straight meeting, but by 50 basis points instead of 75 basis points, as it had for the past four times.

The Week Ahead, Dec. 12, 2022: The Fed and Five Other Things to Know

Good morning, and happy Monday! The holidays are coming up quickly, and a lot has to happen before then. Here’s what you need to know this week: