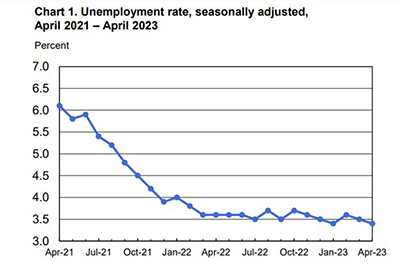

The U.S. economy added 253,000 jobs in April, and the unemployment rate fell again to match a 53-year low, beating analyst expectations, the Bureau of Labor Statistics reported Friday.

Tag: Mike Fratantoni

Fed Raises Rates; Is That It?

The Federal Open Market Committee on Wednesday, as expected, raised the federal funds rate by another 25 basis points to its highest level since July 2007. And while it hinted this might be the final increase for a while, it left open the door for more action should economic conditions warrant.

MBA Research Roundup May 2023

Each month, MBA Research releases a roundup of recent data, activities and other pertinent developments crucial to the real estate finance industry. For more information regarding MBA Research products, click on the headline.

MBA Weekly Applications Survey Apr. 12: Applications Increase

Mortgage applications increased 5.3 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending April 7, 2023.

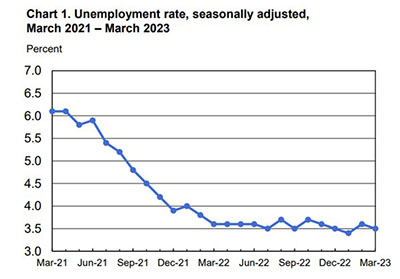

Employment Show Signs of Slowing

Total nonfarm payroll employment rose by 236,000 in March, the Bureau of Labor Statistics reported Friday—the smallest increase in more than two years, but enough to push the unemployment rate down to 3.5 percent.

#MBATech23: Challenging Economic Conditions Persist

SAN JOSE, Calif.—After several years of extraordinary—and unexpected—mortgage performance despite the coronavirus pandemic, 2023 is a decidedly different—and less desirable—business environment, said MBA economists.

#MBATech23: Technology Investors Stress Patience

SAN JOSE, Calif.—The mortgage industry wants innovation; tech innovation requires capital. Wall Street investors have unique perspectives on the mortgage industry—and the technology that should support it.

#MBATech23: Challenging Economic Conditions Persist

SAN JOSE, Calif.—After several years of extraordinary—and unexpected—mortgage performance despite the coronavirus pandemic, 2023 is a decidedly different—and less desirable—business environment, said MBA economists.

MBA Weekly Survey Apr. 5, 2023: Applications Fall for First Time in 5 Weeks

Mortgage applications fell for the first time in five weeks, despite another drop in interest rates, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Apr. 5.

MBA Weekly Survey Apr. 5, 2023: Applications Fall for First Time in 5 Weeks

Mortgage applications fell for the first time in five weeks, despite another drop in interest rates, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Apr. 5.