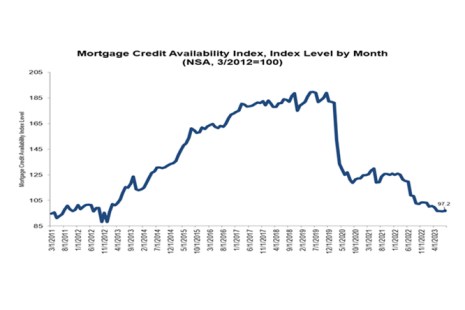

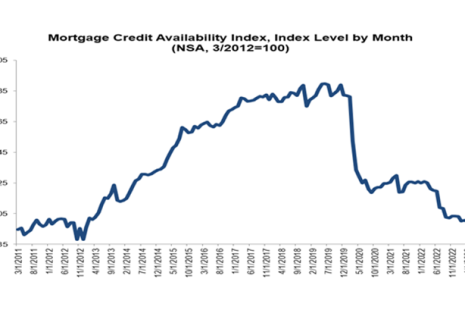

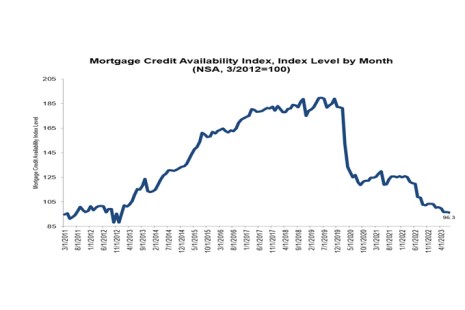

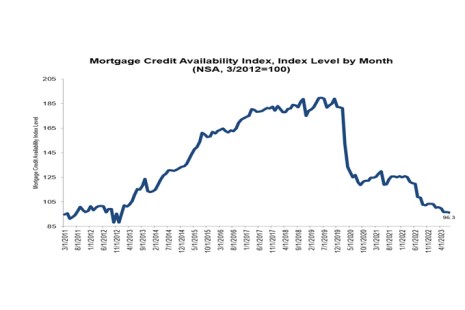

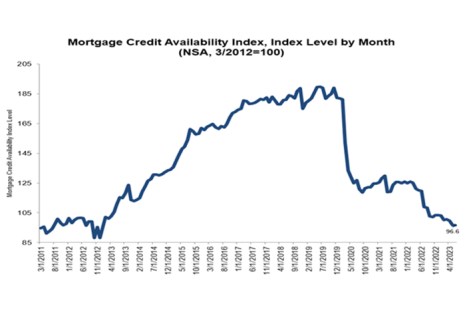

Mortgage credit availability increased in October according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.

Tag: MCAI

Quote: Nov. 14, 2023

“Despite the uptick in credit availability recently, we are still close to the lowest levels since 2013. Loan offerings remain narrower as lenders have reduced capacity to cope with the lower origination volumes.”

–Joel Kan, MBA Vice President and Deputy Chief Economist.

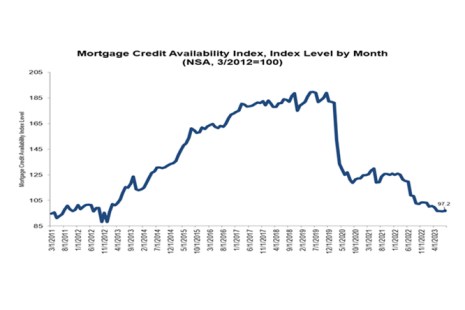

Mortgage Credit Availability Increased in September

Mortgage credit availability increased in September according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

Mortgage Credit Availability Increased in September

Mortgage credit availability increased in September according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

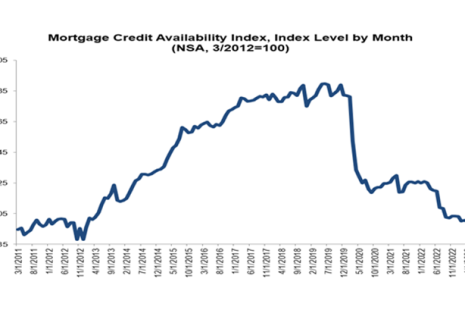

MBA: Mortgage Credit Availability Increased in August

Mortgage credit availability increased in August according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.

MBA: Mortgage Credit Availability Increased in August

Mortgage credit availability increased in August according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.

Mortgage Credit Availability Decreased in July

Mortgage credit availability decreased in July according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.

Mortgage Credit Availability Decreased in July

Mortgage credit availability decreased in July according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.

Mortgage Credit Availability Increased in June

Mortgage credit availability increased in June according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.

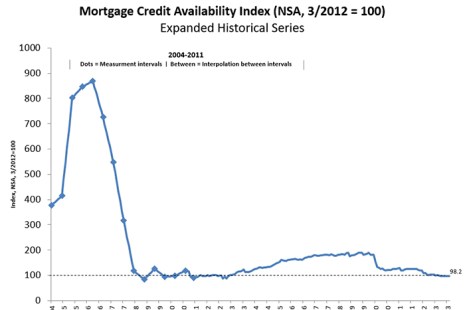

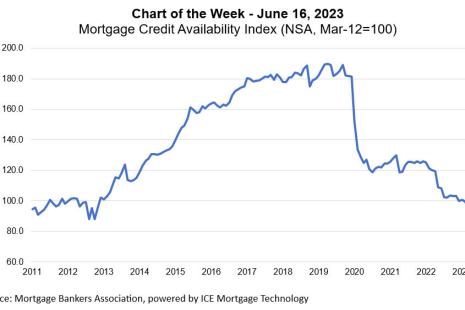

MBA Chart of the Week June 20, 2023: Mortgage Credit Availability Index

According to data from MBA’s May 2023 Mortgage Credit Availability Index (MCAI), we saw the third consecutive month of declining credit availability, as the industry continued to see more consolidation and reduced capacity as a result of the tougher market.