Mortgage Credit Availability Increased in June

(Image courtesy of MBA; Powered by ICE Mortgage Technology)

Mortgage credit availability increased in June according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association that analyzes data from ICE Mortgage Technology.

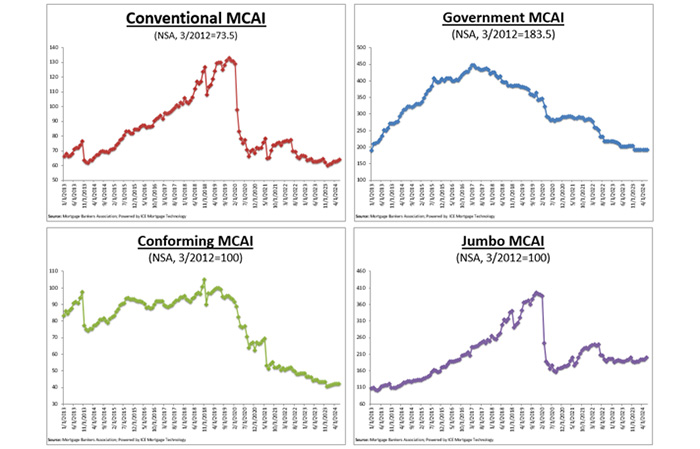

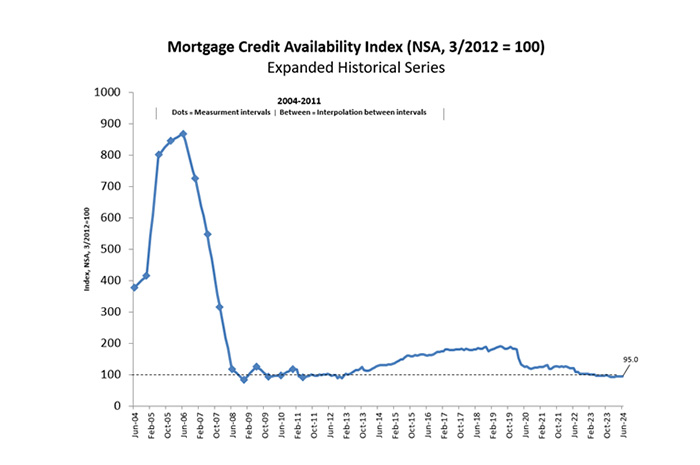

The MCAI rose by 1% to 95.0 in June. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 2%, while the Government MCAI decreased by 0.1%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 3.1%, and the Conforming MCAI fell by 0.3%.

“Mortgage credit availability increased in June for the sixth consecutive month, as lenders expanded their offerings of cash-out refinance loan programs,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The recent growth in credit availability is encouraging, but the index is still hovering near 2012 lows. The jumbo index increased to its highest level since August 2022, but the conforming and government indices continue to indicate tight credit conditions, driven mainly by reduced industry capacity.”

CONVENTIONAL, GOVERNMENT, CONFORMING, AND JUMBO MCAI COMPONENT INDICES

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

EXPANDED HISTORICAL SERIES

The Total MCAI has an expanded historical series that gives perspective on credit availability going back approximately 10-years (expanded historical series does not include Conventional, Government, Conforming, or Jumbo MCAI). The expanded historical series covers 2004 through 2010 and was created to provide historical context to the current series by showing how credit availability has changed over the last 10 years – including the housing crisis and ensuing recession. Data prior to March 31, 2011, was generated using less frequent and less complete data measured at 6-month intervals and interpolated in the months between for charting purposes. Methodology on the expanded historical series from 2004 to 2010 has not been updated.

ABOUT THE MORTGAGE CREDIT AVAILABILITY INDEX

The MCAI provides the only standardized quantitative index that is solely focused on mortgage credit.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

To learn more about the ICE Mortgage Technology platform click here.

For more information on the Mortgage Credit Availability Index, including Frequently Asked Questions and other relevant resources, please click here or contact MBAResearch@mba.org.