As we summarize the state of the mortgage market in 2023, there is one series in particular that encapsulates the situation, mortgage interest rates.

Tag: MBA Forecast

MBA Forecast: Mortgage Originations to Increase 19% to $1.95 Trillion in 2024

PHILADELPHIA–The Mortgage Bankers Association announced at its 2023 Annual Convention & Expo that total mortgage origination volume is expected to increase to $1.95 trillion in 2024 from the $1.64 trillion expected in 2023.

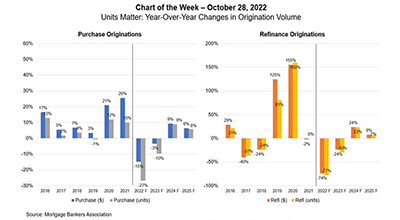

MBA Chart of the Week Oct. 28 2022: Year-Over-Year Changes in Origination Volume

This week’s MBA Chart of the Week examines year-over-year changes in origination volume ($ and units) dating back to 2016, and the forecasted volume from 2022 to 2025. In 2022, we expect a 15% decline in purchase origination dollars from 2021 but a steeper 27% decrease in the number of loans.

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

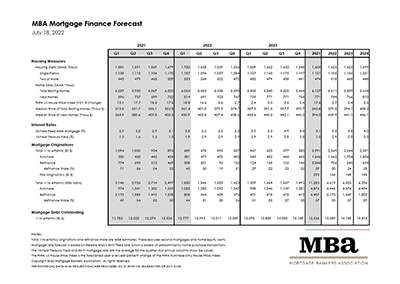

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

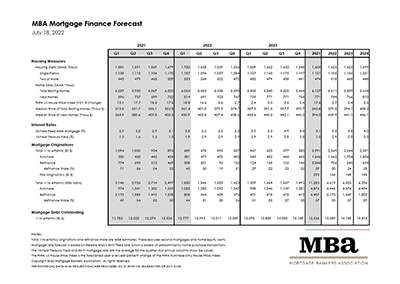

MBA Forecast: Recession Likely in 2023, Mortgage Originations to Decline 9% to $2.05 Trillion

NASHVILLE—The Mortgage Bankers Association said total mortgage origination volume is expected to decline to $2.05 trillion in 2023 from the $2.26 trillion expected in 2022. Purchase originations are forecast to decrease by 3 percent to $1.53 trillion next year, while refinance volume is anticipated to decline by 24 percent to $513 billion.

MBA Updates Economic, Mortgage Market Forecasts

The Mortgage Bankers Association released updated Economic and Mortgage Market forecasts Thursday.

MBA Updates Economic, Mortgage Market Forecasts

The Mortgage Bankers Association released updated Economic and Mortgage Market forecasts Thursday.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.