MBA Chart of the Week: 30-Year Fixed Rate

Sources: MBA Weekly Applications Survey Contract Interest Rate, MBA Forecast

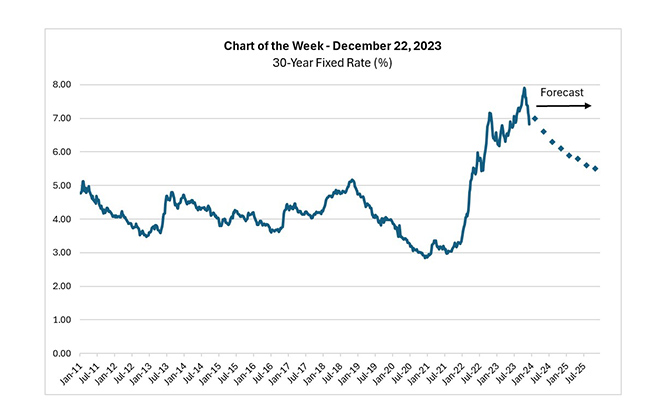

As we summarize the state of the mortgage market in 2023, there is one series in particular that encapsulates the situation, mortgage interest rates.

After falling to record lows in late 2020 and remaining in the 3% range in 2021, rates climbed to over 7% in October 2022 and started 2023 at around 6.5%. 2023 has been rocky, with the MBA Weekly Applications Survey (WAS) 30-year fixed contract interest rate reaching 7.90% in October before retreating to the most recent reading of 6.83%.

Economic prices convey a lot of information, and mortgage rates summarize, among other factors, the Federal Reserve’s actions to fight inflation, inherent uncertainty about future Treasury rates (e.g., Quantitative Tightening and large fiscal deficits), and the high value of mortgage prepayment options due to increased underlying interest rate volatility (leading to almost 300 basis point mortgage to Treasury spreads).

The effect of the 2023 rate environment has been to reduce the WAS Refinance Index by 89% compared to 2020-21 averages and shrink WAS purchase applications by 30% year to date. This year has been challenging, and MBA estimates that this year’s total originations will be $1.64 trillion. Moreover, with house price appreciation remaining positive, MBA’s Purchase Applications Payment Index (PAPI) shows that conditions remain tough for prospective homebuyers.

With 2023 almost behind us, what can we expect for 2024 and 2025? The Federal Open Market Committee’s Summary of Economic Projections moved from September’s higher-for-longer fed funds rate projection to a higher-for-not-so-much-longer projection in last week’s release. This is welcome news for the mortgage market. MBA’s forecast (blue diamonds in the chart) shows a steady decline to 6.1% and 5.5% in 2024 Q4 and 2025 Q4, with originations increasing to $2.00 trillion (22%) and $2.34 trillion (17%) in 2024 and 2025, respectively.

The MBA Research and Economics team wishes all our Chart of the Week recipients a happy and healthy holiday season and the very best for the New Year.

–Eddie Seiler