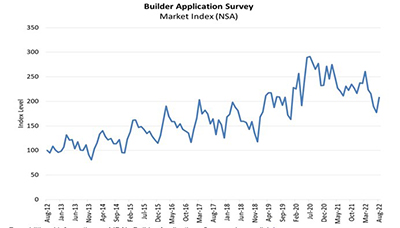

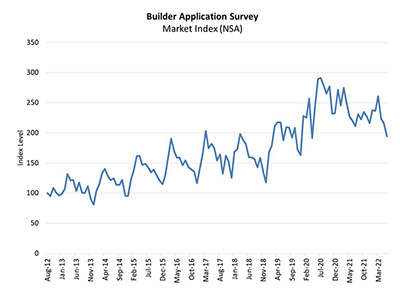

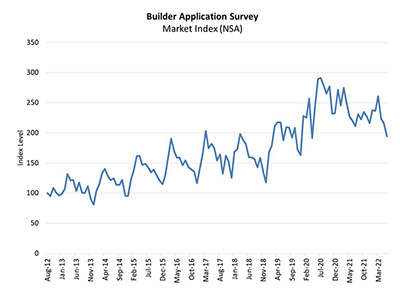

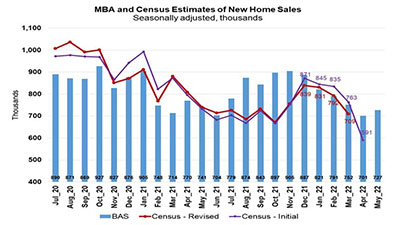

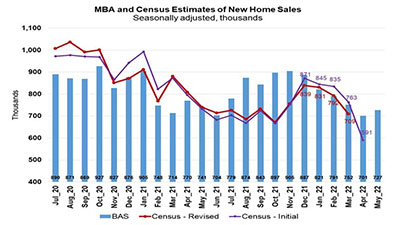

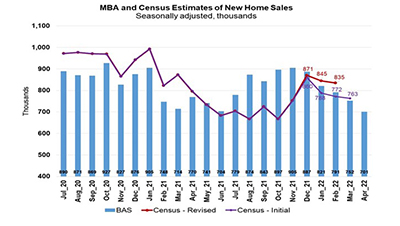

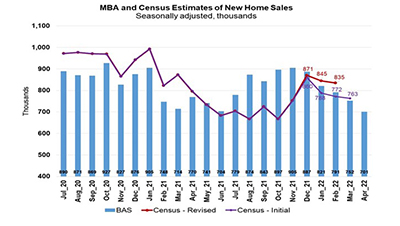

The Mortgage Bankers Association Builder Applications Survey reported mortgage applications for new home purchases in August rose by 17 percent from July—the first monthly increase in four months—but fell by 10.1 percent from a year ago.

Tag: MBA Builder Applications Survey

MBA Builder Applications Survey Up 17% from July

The Mortgage Bankers Association Builder Applications Survey reported mortgage applications for new home purchases in August rose by 17 percent from July—the first monthly increase in four months—but fell by 10.1 percent from a year ago.

MBA Builder Applications Survey Falls for 4th Straight Month

The Mortgage Bankers Association Builder Applications Survey reported mortgage applications for new home purchases in July fell by 16.1 percent from a year ago, marking the fourth consecutive monthly decrease.

MBA Builder Applications Survey Falls for 4th Straight Month

The Mortgage Bankers Association Builder Applications Survey reported mortgage applications for new home purchases in July fell by 16.1 percent from a year ago, marking the fourth consecutive monthly decrease.

MBA Builder Applications Survey Headline HERE

MBA Builder Applications Survey lede sentence HERE

June Purchase Mortgage Applications for New Homes Decreased 12%

Mortgage applications for new home purchases decreased 12 percent compared to a year ago, the Mortgage Bankers Association’s Builder Application Survey reported.

Rising Rates, Tight Inventories Dampen MBA Builder Apps Survey

May mortgage applications for new home purchases fell by 4 percent from April and by 5 percent from a year ago, the Mortgage Bankers Association reported Thursday.

Rising Rates, Tight Inventories Dampen MBA Builder Apps Survey

May mortgage applications for new home purchases fell by 4 percent from April and by 5 percent from a year ago, the Mortgage Bankers Association reported Thursday.

MBA Builder Apps Survey Shows Monthly, Yearly Declines

Mortgage applications for new home purchases in April fell by 14 percent from March and by 10.6 percent from a year ago, the Mortgage Bankers Association reported Thursday.

MBA Builder Apps Survey Shows Monthly, Yearly Declines

Mortgage applications for new home purchases in April fell by 14 percent from March and by 10.6 percent from a year ago, the Mortgage Bankers Association reported Thursday.