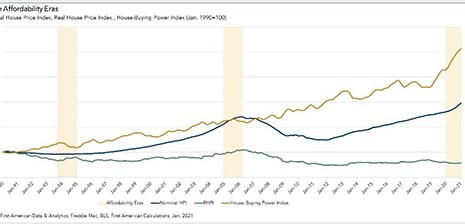

First American Financial Corp., Santa Ana, Calif., said while house prices have increased, house-buying power has also increased because of a long-run decline in mortgage rates and the slow, but steady growth of household income.

Tag: Mark Fleming

Despite Price Spikes, Homeownership Remains Affordable

Two reports—from ATTOM Data Solutions, Irvine, Calif., and First American Financial Corp., Santa Ana, Calif.—say despite sharp spikes in home prices, homeownership remains affordable for most workers, which continues to drive housing demand.

Home Prices Keep Going Up, Up, Up

A flurry of economic reports shows U.S. home price appreciation, triggered by low housing inventories, keep pushing toward—and beyond—double-digit percentage annual growth.

Home Prices Jump on Robust Demand; Housing Gains at 15-Year High

Home prices are rising at rates not seen in years, with four reports—from Standard & Poor’s, Zillow, the Federal Housing Finance Agency and First American Financial Corp.—confirming no apparent letup.

Housing Market Roundup, Jan. 4, 2021

We hope you had an enjoyable holiday break. Here is a summary of some reports that came out over the holidays:

Why the ‘Big Short’ in Housing Supply Will Remain in 2021

Economics is all about supply and demand. In the housing market right now, there’s plenty of demand—but not a lot of supply. And, according to First American Financial Corp., that’s not likely to change any time soon.

Generation Z Renters Moving On Up

More young adults are returning to the rental market reported Zillow, Seattle.

Housing Market Roundup

In this edition of the MBA NewsLink Housing Market Roundup, we look at the latest FHFA Strategic Plan; how consumers are altering their home buying and home selling plans during the coronavirus pandemic; why housing affordability might be at a “tipping point;” how the coronavirus is driving down inventories; and how political preferences are having an effect on where people choose to live–or even stay in America.

Signs Point Toward Continued House Price Appreciation

Ahead of this morning’s S&P CoreLogic Case-Shiller Home Price Indexes, a report from First American Financial Corp., Santa Ana, Calif., said low mortgage rates, tight supply and demographic demand will continue to drive home price appreciation well into autumn.

Lack of Supply Hinders Housing Market’s Full Potential

Despite the housing market’s show of strength this summer amid economic turmoil sparked by the coronavirus pandemic, it has yet to reach its full potential because of ongoing supply restraints, said First American Financial Corp., Santa Ana, Calif.