LendingTree, Charlotte, N.C., found the median planned down payment has increased sharply since 2021. Planned down payments now account for larger shares of loan amounts and borrowers’ incomes, too.

Tag: LendingTree

Property Insurance Makes Up 7% of Housing Costs in Big Metros, ValuePenguin Reports

Homeowners in the 50 largest U.S. metros now spend an average of 7% of their monthly housing costs insuring their homes, according to the latest ValuePenguin by LendingTree study.

LendingTree: Property Taxes Rise in Large Metros

LendingTree, Charlotte, N.C., found median property taxes in the U.S. rose by an average of 10.4% from 2021-2023. They also rose in the largest 50 U.S. metro areas during that time period.

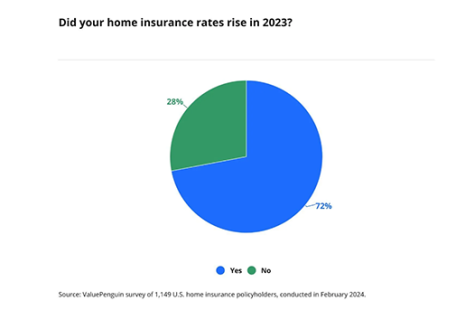

ValuePenguin: Two-Thirds of Home Insurance Policyholders Say Rates Rose Last Year

ValuePenguin, a division of LendingTree, Charlotte, N.C., found that two in three home insurance policyholders say their rates rose in 2024.

LendingTree: 13.6% of Homes Are Uninsured

LendingTree, Charlotte, N.C., reported approximately one in seven homes across the U.S. are uninsured.

LendingTree: Young Homeowners Underrepresented in Largest Metros

LendingTree, Charlotte, N.C., released a new study finding that only 3.1% of Americans under 30 have a mortgage in the 50 largest U.S. metro areas.

Manufactured Home Prices Rising Faster Than Site-Built Home Prices: LendingTree

The average sales price of new manufactured homes rose by 58% between 2018 and 2023, compared to a 37% increase for new site-built single-family homes (excluding land), according to LendingTree, Charlotte, N.C.

LendingTree: 5.6 Million Homes Vacant in Largest U.S. Metro Areas

LendingTree, Charlotte, N.C., reported that 5.6 million housing units are vacant in the largest 50 metro areas in the U.S.–and ranked which ones top that list.

LendingTree: Majority of Buyers Don’t Shop for a Mortgage, Though 45% of Those Who Do Receive a Better Offer

Most homebuyers are not shopping around for their mortgage despite the potential savings, according to LendingTree, Charlotte, N.C.

LendingTree: 1 in 4 Worry Their Home Will Be ‘Uninsurable’ in 2024

More than one-quarter of U.S. homeowners worry their homes will become “uninsurable” as rates continue to increase, reported LendingTree, Charlotte, N.C.