LendingTree: 1 in 4 Worry Their Home Will Be ‘Uninsurable’ in 2024

(Illustration courtesy of LendingTree)

More than one-quarter of U.S. homeowners worry their homes will become “uninsurable” as rates continue to increase, reported LendingTree, Charlotte, N.C.

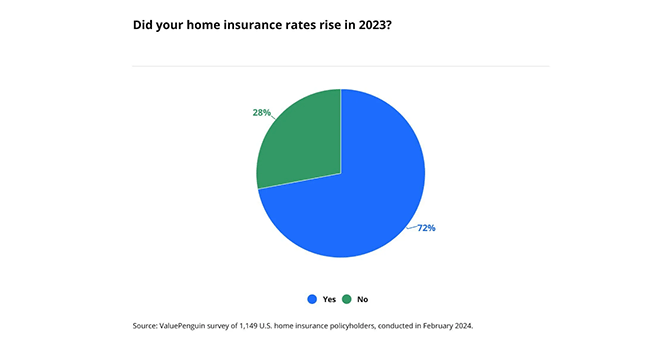

A new report from LendingTree subsidiary ValuePenguin found that 72% of U.S. homeowners experienced insurance rate hikes last year and nearly 20% received a non-renewal notice from their insurer.

The report noted 37% of homeowners saw their insurance premiums rise 5 to 10% last year and nearly one-quarter of homeowners reported rate hikes of exceeding 11% in 2023.

Three-quarters of homeowners surveyed said they are braced for more rate hikes this year, while 8% have opted to go without homeowners insurance.

Nearly three-quarters of insurance policyholders blamed inflation for insurance increases, followed by rising home prices, homeowners filing more claims, insurance company greed and climate change.

ValuePenguin analyst Divya Sangameshwar noted a big driver of price increases is the rising volume and cost of claims. “Climate change has led to increases in the number and severity of hurricanes, floods, tornadoes, drought, heat waves and other harsh weather, which have led to a spike in the volume of claims in many parts of the country,” she said.

Any solution to the homeowners insurance crisis should also address the issues causing an increase in the volume and cost of claims, the report noted. “Namely inflation, outdated building codes, building homes in high disaster risk areas and climate change,” Sangameshwar added.