The spread of the coronavirus has slowed global and U.S. economic activity to a halt. Public and private measures to stem the spread of the virus have led to indefinite interruptions in many sectors of the economy, as well as future uncertainty surrounding how long this pause in the global economy will last and what the potential economic losses could be.

Tag: Joel Kan

Mortgage Applications Back Up in MBA Weekly Survey

Mortgage application activity entered March like a lamb, but, thanks to falling interest rates, came out like a lion.

Mortgage Applications Back Up in MBA Weekly Survey

Mortgage application activity entered March like a lamb, but, thanks to falling interest rates, came out like a lion.

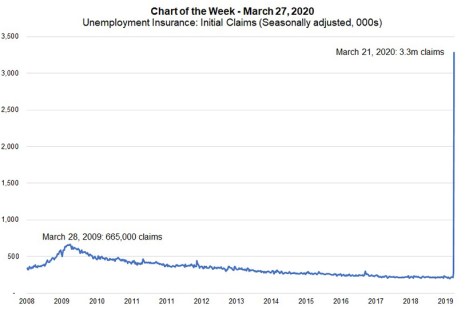

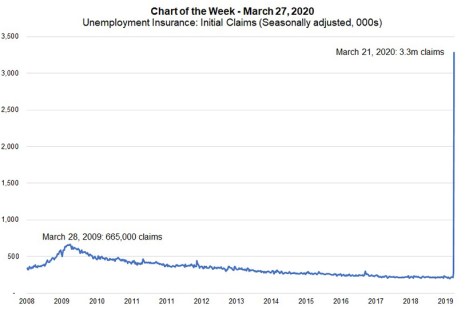

MBA Chart of the Week: Unemployment Insurance–Initial Claims

Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus.

MBA Chart of the Week: Unemployment Insurance–Initial Claims

Last week provided our first indication of just how severe the shutdown of the U.S. economy could be, as Americans combat the ongoing spread of the coronavirus.

Mortgage Applications Tumble in MBA Weekly Survey

Mortgage applications took a tumble this week as key interest rates jumped to their highest level since January amid increased economic turmoil, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending March 20.

Mortgage Applications Tumble in MBA Weekly Survey

Mortgage applications took a tumble this week as key interest rates jumped to their highest level since January amid increased economic turmoil, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending March 20.

February Existing Home Sales Hit 13-Year High

Existing home sales rebounded in February to their highest level since Feb. 2007, the National Association of Realtors reported Friday.

Calm Before the Storm? February Housing Starts Dip 1.5%, Pre-Coronavirus

HUD and the Census Bureau reported privately owned housing starts in February fell slightly to a seasonally adjusted annual rate of 1.599 million—a not discouraging number, analysts said, ahead of the yet-to-be-seen impact of the coronavirus pandemic.

Mortgage Applications Down in MBA Weekly Survey

It seemed inevitable: after a huge 55 percent jump last week—and a sharp increase in mortgage interest rates in recent days—mortgage applications really had no place to go but down this week.