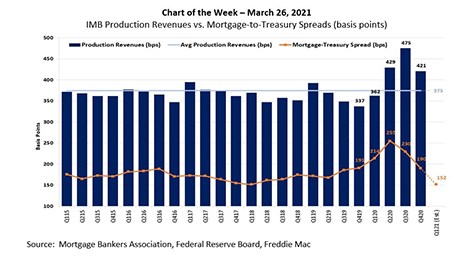

In this Chart of the Week, we compare in basis points the average quarterly credit spreads between the 30‐year mortgage rate (as surveyed by Freddie Mac) and the 10‐year Treasury yield to production revenues (fee income, secondary marketing income and warehouse spread).

Tag: Joel Kan

MBA Weekly Applications Survey Mar. 24, 2021: Rising Rates Stall Refis

Steadily rising mortgage interest rates reached a nine-month high last week, putting the buzzkill on refinance activity, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 19.

MBA Weekly Applications Survey Mar. 24, 2021: Rising Rates Stall Refis

Steadily rising mortgage interest rates reached a nine-month high last week, putting the buzzkill on refinance activity, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending March 19.

MBA Weekly Applications Survey Mar. 17, 2021: Steady Rise in Rates Dampens Activity

Mortgage interest rates continued their slow but steady rise—reaching a nine-month high—putting a damper on refinance applications, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 12.

MBA Weekly Applications Survey Mar. 17, 2021: Steady Rise in Rates Dampens Activity

Mortgage interest rates continued their slow but steady rise—reaching a nine-month high—putting a damper on refinance applications, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 12.

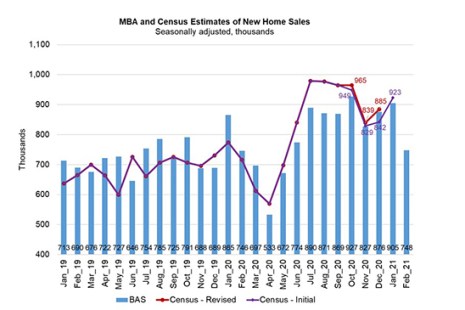

February New Home Applications Down 9% from January; Up 9.2% from Year Ago

The Mortgage Bankers Association Builder Applications Survey data for February show mortgage applications for new home purchases increased 9.2 percent from a year ago, but fell by 9 percent from January, unadjusted for typical seasonal patterns.

February New Home Applications Down 9% from January; Up 9.2% from Year Ago

The Mortgage Bankers Association Builder Applications Survey data for February show mortgage applications for new home purchases increased 9.2 percent from a year ago, but fell by 9 percent from January, unadjusted for typical seasonal patterns.

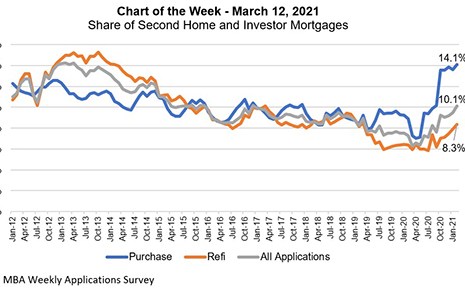

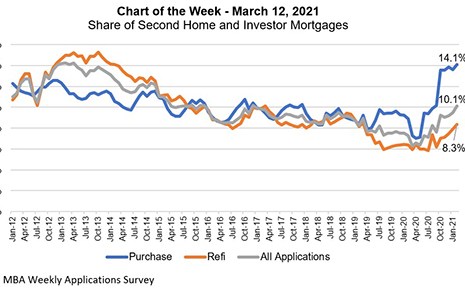

MBA Chart of the Week, Mar. 15, 2021: Share of Second Home & Investor Mortgages

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a second home or investment property.

MBA Chart of the Week, Mar. 15, 2021: Share of Second Home & Investor Mortgages

This week’s MBA Chart of the Week captures the share of mortgage applications to purchase or refinance a second home or investment property.

MBA Weekly Applications Survey Mar. 10, 2021: Rising Rates Send Applications Down

Mortgage applications fell by 1.3 percent from one week earlier as key mortgage rates jumped to their highest rate since last July, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 5.