The highest interest rates since July sent mortgage applications—and in particular, refinance applications—down sharply, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending October 1.

Tag: Joel Kan

MBA Weekly Applications Survey Sept. 29, 2021: Higher Treasury Yields Push Rates Up; Applications Down

Mortgage applications fell last week as mortgage rates reached their highest level since July, the Mortgage Bankers Association reported Tuesday in its Weekly Mortgage Applications Survey for the week ending September 24.

MBA Weekly Applications Survey Sept. 29, 2021: Higher Treasury Yields Push Rates Up; Applications Down

Mortgage applications fell last week as mortgage rates reached their highest level since July, the Mortgage Bankers Association reported Tuesday in its Weekly Mortgage Applications Survey for the week ending September 24.

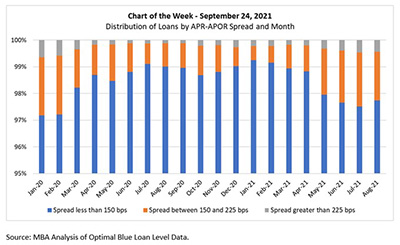

MBA Chart of the Week, Sept. 24, 2021: Distribution of Loans by APR-APOR Spread & Month

In this week’s MBA Chart of the Week, we analyze Optimal Blue single-family, 30-year fixed mortgage rate origination loan data from January 2020 through August 2021. We further group loans in the chart by the spread between their reported note rate and the (monthly average of the) Freddie Mac Primary Mortgage Market Survey rates to approximate the APR-APOR spread.

MBA Chart of the Week, Sept. 24, 2021: Distribution of Loans by APR-APOR Spread & Month

In this week’s MBA Chart of the Week, we analyze Optimal Blue single-family, 30-year fixed mortgage rate origination loan data from January 2020 through August 2021. We further group loans in the chart by the spread between their reported note rate and the (monthly average of the) Freddie Mac Primary Mortgage Market Survey rates to approximate the APR-APOR spread.

MBA Weekly Applications Survey Sept. 15, 2021: Refis Rebound; Purchase Applications Highest in 5 Months

After laying low for a while, refinance applications came roaring back last week, while purchase applications reached their highest level since April, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending September 17.

MBA Weekly Applications Survey Sept. 15, 2021: Refis Rebound; Purchase Applications Highest in 5 Months

After laying low for a while, refinance applications came roaring back last week, while purchase applications reached their highest level since April, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending September 17.

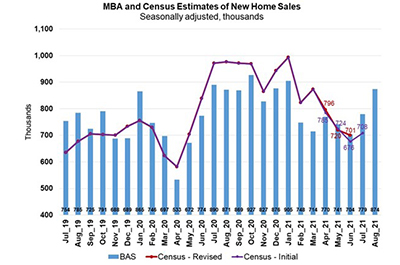

MBA: August New Home Applications Up 9% From July, Down 17% from Year Ago

The Mortgage Bankers Association’s latest Builder Applications Survey reported mortgage applications for new home purchases increased by 9 percent in August from July but decreased by 17 percent from a year ago.

MBA: August New Home Applications Up 9% From July, Down 17% from Year Ago

The Mortgage Bankers Association’s latest Builder Applications Survey reported mortgage applications for new home purchases increased by 9 percent in August from July but decreased by 17 percent from a year ago.

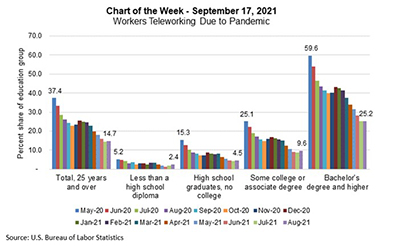

MBA Chart of the Week Sept. 17 2021–Teleworking Due to Pandemic

The COVID-19 pandemic has forced many businesses to change the way they operate, and even 18 months later, there are different views and strategies for the workplace, with teleworking at the center of many discussions.