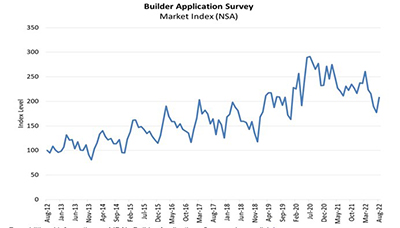

The Mortgage Bankers Association Builder Applications Survey reported mortgage applications for new home purchases in August rose by 17 percent from July—the first monthly increase in four months—but fell by 10.1 percent from a year ago.

Tag: Joel Kan

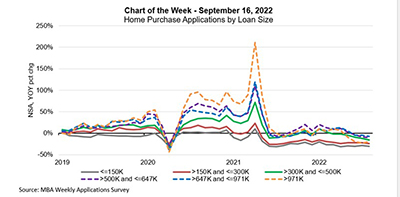

MBA Chart of the Week, Sept. 16, 2022: Home Purchase Applications by Loan Size

The housing market continues to face challenges from economic uncertainty, high home-price growth and volatile mortgage rates. MBA’s Weekly Applications Survey data show that overall mortgage application activity continues to trend lower, as refinances have quickly dried up due to rates rising throughout the year and hitting the 6-percent mark for the first time since 2008.

MBA Chart of the Week, Sept. 16, 2022: Home Purchase Applications by Loan Size

The housing market continues to face challenges from economic uncertainty, high home-price growth and volatile mortgage rates. MBA’s Weekly Applications Survey data show that overall mortgage application activity continues to trend lower, as refinances have quickly dried up due to rates rising throughout the year and hitting the 6-percent mark for the first time since 2008.

MBA Weekly Survey Sept. 14, 2022: Applications Fall 6th Straight Week; Interest Rates Top 6%

Mortgage applications fell for the sixth straight week as interest rates topped 6 percent, although purchase applications showed signs of life, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 9.

MBA Weekly Survey Sept. 14, 2022: Applications Fall 6th Straight Week; Interest Rates Top 6%

Mortgage applications fell for the sixth straight week as interest rates topped 6 percent, although purchase applications showed signs of life, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 9.

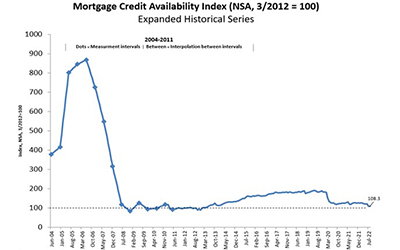

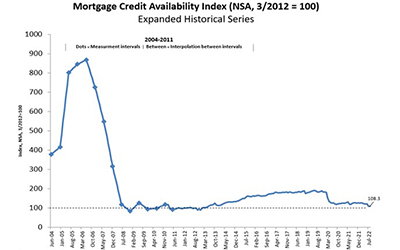

Mortgage Credit Availability Falls for 6th Straight Month

Mortgage credit availability fell for the sixth straight month in August, remaining at its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

Mortgage Credit Availability Falls for 6th Straight Month

Mortgage credit availability fell for the sixth straight month in August, remaining at its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

MBA Weekly Survey Aug. 24, 2022: Rates Jump; Activity at ‘Multi-Decade Low’

Mortgage applications fell for the fourth straight week, remaining at their lowest level in 22 years as interest rates jumped to its highest level since July, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 26.

MBA Weekly Survey Aug. 24, 2022: Rates Jump; Activity at ‘Multi-Decade Low’

Mortgage applications fell for the fourth straight week, remaining at their lowest level in 22 years as interest rates jumped to its highest level since July, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 26.

MBA Weekly Survey Aug. 24, 2022: Applications Fall for 3rd Straight Week

Mortgage applications fell for the third straight week, remaining at their lowest level in 22 years, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 19.