Mortgage applications increased 0.5 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending June 16, 2023.

Tag: Joel Kan

MBA Weekly Survey June 21, 2023: Mortgage Applications Increase

Mortgage applications increased 0.5 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending June 16, 2023.

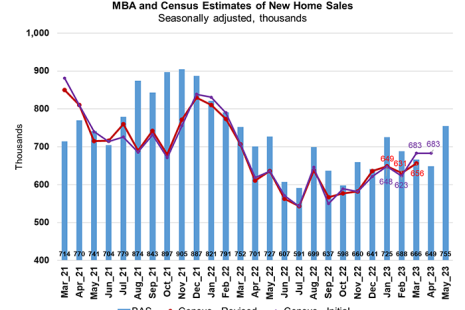

MBA: May New Home Purchase Mortgage Applications Increased 16.6%

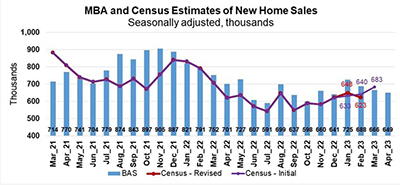

The Mortgage Bankers Association’s Builder Application Survey for May 2023 shows mortgage applications for new home purchases increased 16.6 percent compared from a year ago.

MBA: May New Home Purchase Mortgage Applications Increased 16.6%

The Mortgage Bankers Association’s Builder Application Survey for May 2023 shows mortgage applications for new home purchases increased 16.6 percent compared from a year ago.

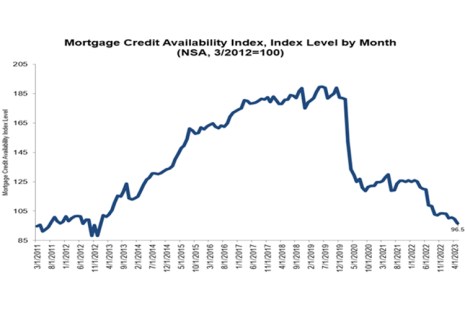

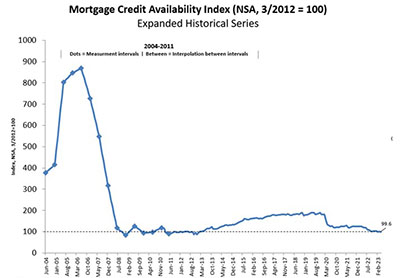

Mortgage Credit Availability Down in May

Mortgage credit availability fell in May, the Mortgage Bankers Association reported Tuesday.

May Mortgage Credit Availability

Mortgage credit availability to come.

MBA Weekly Survey May 24, 2023: Mortgage Applications Decrease

Mortgage applications fell again last week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 19.

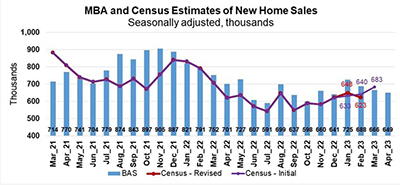

MBA: April New Home Purchase Mortgage Applications Down 11% from March; Up 4.1% from Year Ago

The Mortgage Bankers Association said April mortgage applications for new home purchases fell by 11 percent from March but rose by 4.1 percent from a year ago.

MBA: April New Home Purchase Mortgage Applications Down 11% from March; Up 4.1% from Year Ago

The Mortgage Bankers Association said April mortgage applications for new home purchases fell by 11 percent from March but rose by 4.1 percent from a year ago.

MBA Weekly Survey May 17, 2023: Rates Up, Applications Down

Mortgage applications fell last week as interest rates rose, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 12.