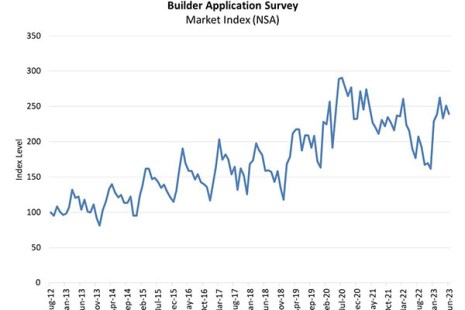

The Mortgage Bankers Association Builder Application Survey data for June 2023 shows mortgage applications for new home purchases increased 26.1 percent compared from a year ago.

Tag: Joel Kan

MBA Weekly Survey July 19, 2023: Mortgage Applications Increase

Mortgage applications increased 1.1 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 14, 2023.

MBA Weekly Survey July 12, 2023: Applications Increase

Mortgage applications increased 0.9 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 7, 2023.

MBA Weekly Survey July 12, 2023: Applications Increase

Mortgage applications increased 0.9 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 7, 2023.

MBA Weekly Survey July 12, 2023: Applications Increase

Mortgage applications increased 0.9 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 7, 2023.

Quote: July 11, 2023

“Mortgage credit availability was essentially unchanged in June, remaining close to the lowest level since early 2013, as the industry continues to operate at reduced capacity.” –Joel Kan, MBA Vice President and Deputy Chief Economist.

MBA Weekly Survey July 6, 2023: Mortgage Applications Decrease

Mortgage applications decreased 4.4 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending June 30, 2023.

MBA Weekly Survey July 6, 2023: Mortgage Applications Decrease

Mortgage applications decreased 4.4 percent from one week earlier, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending June 30, 2023.

MBA Weekly Survey June 28, 2023: Mortgage Applications Increase Again

Mortgage applications increased 3.0 percent from one week earlier, the Mortgage Bankers Association’s Weekly Mortgage Applications Survey reported for the week ending June 23, 2023.

MBA Weekly Survey June 28, 2023: Mortgage Applications Increase Again

Mortgage applications increased 3.0 percent from one week earlier, the Mortgage Bankers Association’s Weekly Mortgage Applications Survey reported for the week ending June 23, 2023.