Total commercial and multifamily mortgage borrowing and lending is expected to rise to $576 billion in 2024, which is a 29% increase from 2023’s estimated total of $444 billion. This is according to an updated baseline forecast released today by the Mortgage Bankers Association (MBA).

Tag: Jamie Woodwell

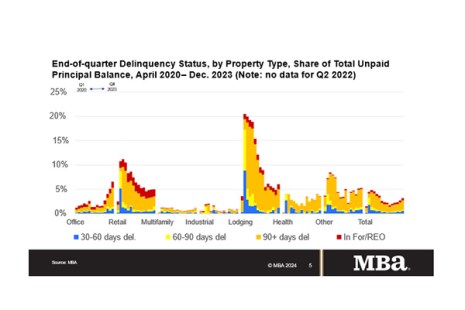

MBA Chart of the Week: End of Quarter Delinquency Status

Ongoing challenges in commercial real estate markets pushed the delinquency rate on CRE-backed loans higher in the final three months of 2023.

MBA: Delinquency Rates for Commercial Properties Increased in Fourth-Quarter 2023

Delinquency rates for mortgages backed by commercial properties increased during the fourth quarter of 2023, according to the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey.

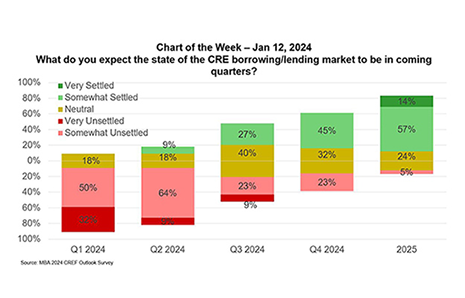

MBA Chart of the Week: Expectations for the CRE Borrowing/Lending Market

Even though many commercial real estate loans are long-lived, there’s a sense that the industry starts each year fresh. Sometimes, that means losing credit for all the deals and successes of the previous twelve months. Sometimes – like now – it means being able to put last year in the rearview mirror.

MBA CREF Outlook Survey: Markets Expected to Become Less Unsettled as 2024 Progresses

Commercial and multifamily mortgage originators continue to experience an unsettled market for borrowing and lending but anticipate those conditions will stabilize over the course of 2024.

MBA’s Q3 2023 Commercial/Multifamily DataBook Provides Insights as New Year Begins

Commercial real estate markets are entering the new year relatively stuck. Through the first three quarters of 2023, property sales and mortgage origination volumes are each down 50-plus percent compared to the year prior.

MBA: Commercial and Multifamily Mortgage Debt Outstanding Increased by $37 Billion in Third Quarter

The level of commercial/multifamily mortgage debt outstanding increased by $37.1 billion (0.8%) in the third quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

MBA: Commercial Mortgage Delinquency Rates Increased in Third Quarter

Commercial mortgage delinquencies increased in the third quarter, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

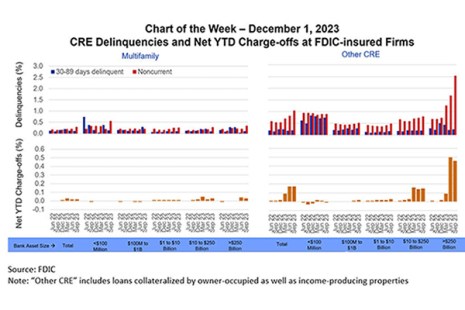

MBA Chart of the Week: CRE Delinquencies and Net YTD Charge-offs at FDIC-Insured Firms

Since March 2023, a recurring set of questions has revolved around a) how conditions in commercial real estate are affecting banks and b) how conditions with banks are affecting CRE.

MBA: Commercial/Multifamily Borrowing Down 49% in Third Quarter

Commercial and multifamily mortgage loan originations were 49% lower in the third quarter of 2023 compared to a year ago, and decreased 7% from the second quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.