MBA CREF Outlook Survey: Markets Expected to Become Less Unsettled as 2024 Progresses

(Image courtesy of MBA)

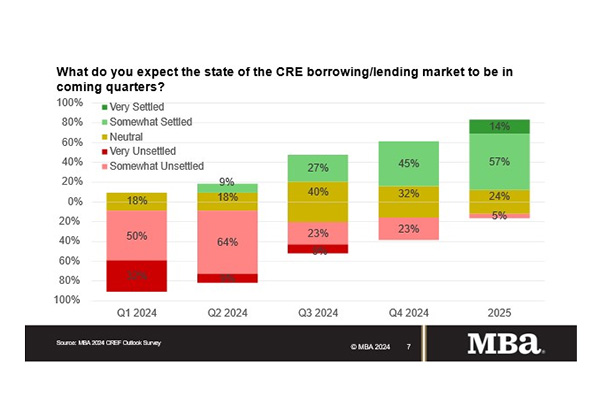

Commercial and multifamily mortgage originators continue to experience an unsettled market for borrowing and lending but anticipate those conditions will stabilize over the course of 2024. That is according to the Mortgage Bankers Association’s 2024 Commercial Real Estate Finance Outlook Survey, which polled the leaders of the top commercial and multifamily mortgage finance firms for their outlook for the year ahead.

“Commercial real estate markets are entering 2024 amid a great deal of uncertainty and, as a result, a significant slowdown in activity,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research. “Leaders of top commercial real estate finance firms believe that a host of factors may continue to act as a drag – rather than a boost – to the markets. However, they do believe that overall uncertainty will dissipate over the year, helping to boost borrowing and lending above 2023 levels.”

Highlights of MBA’s 2024 CREF Outlook Survey include:

• More than 90% of respondents consider today’s market either somewhat or very unsettled.

• Among property types, the office market is viewed as most negatively affecting today’s borrowing and lending. Meanwhile, half of respondents view the industrial outlook as having positive impacts.

• Cap rates and valuations, base interest rates, and rate volatility are all viewed as having negative impacts on today’s financing activity.

• Originators expect the market to stabilize over the course of 2024.

• In 2024, lenders are expected to have a (slightly) stronger appetite to lend than borrowers will have to borrow.

• Borrowing and lending volumes are generally expected to rise in 2024.

• Expectations for particular capital sources vary broadly.

• There is a wide range of views as to whether the supply of or demand for debt is greater.

• Across a variety of factors affecting the CRE finance volumes, more are seen as negative than positive for 2024.

The 2024 MBA CREF Outlook Survey was conducted between Nov. 30 and Dec. 15, 2023. The survey request was sent to leaders at 60 of the top commercial and multifamily mortgage origination firms, as determined by MBA’s 2022 Annual Origination Rankings Report. The survey had a response rate of 40%. Percentages shown are calculated based on applicable responses. Non-responses and “n.a.” responses are excluded from the percentage denominator.

Detailed survey results are available to MBA members at www.mba.org/crefresearch.