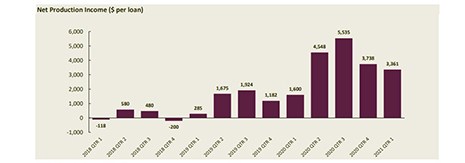

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $3,361 on each loan they originated in the first quarter, down from $3,738 per loan in the fourth quarter but still the highest first-quarter net gain in the history of the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

Tag: Independent Mortgage Banks

To the Point with Bob–IMBs and the CRA: A Misguided Match

In this edition of To the Point with Bob, MBA President & CEO Robert Broeksmit, CMB, says while the Community Reinvestment Act serves an important policy objective, it is inappropriate to apply it to independent mortgage banks.

To the Point with Bob–IMBs and the CRA: A Misguided Match

In this edition of To the Point with Bob, MBA President & CEO Robert Broeksmit, CMB, says while the Community Reinvestment Act serves an important policy objective, it is inappropriate to apply it to independent mortgage banks.

To the Point with Bob–IMBs and the CRA: A Misguided Match

In this edition of To the Point with Bob, MBA President & CEO Robert Broeksmit, CMB, says while the Community Reinvestment Act serves an important policy objective, it is inappropriate to apply it to independent mortgage banks.

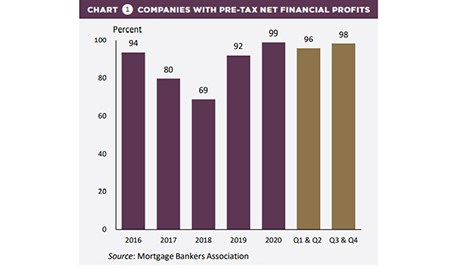

MBA: 2020 IMB Production Volumes, Profits Hit Record-Highs

Independent mortgage banks and mortgage subsidiaries of chartered banks made an average profit of $4,202 on each loan they originated in 2020, up from $1,470 per loan in 2019, the Mortgage Bankers Association reported Wednesday

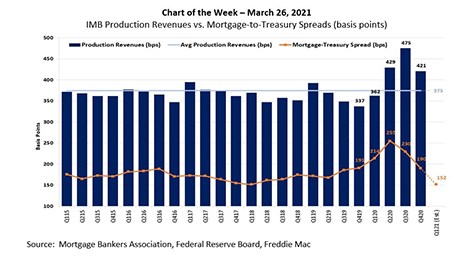

MBA Chart of the Week Mar. 26, 2021: IMB Production Revenues

In this Chart of the Week, we compare in basis points the average quarterly credit spreads between the 30‐year mortgage rate (as surveyed by Freddie Mac) and the 10‐year Treasury yield to production revenues (fee income, secondary marketing income and warehouse spread).

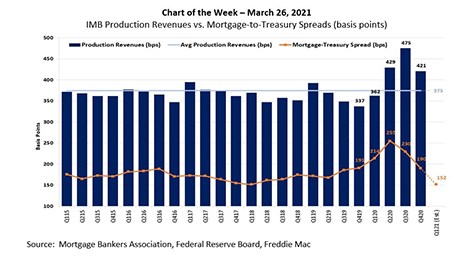

MBA Chart of the Week Mar. 26, 2021: IMB Production Revenues

In this Chart of the Week, we compare in basis points the average quarterly credit spreads between the 30‐year mortgage rate (as surveyed by Freddie Mac) and the 10‐year Treasury yield to production revenues (fee income, secondary marketing income and warehouse spread).

MBA: IMB Production Profits Remain Strong in Fourth Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $3,738 on each loan they originated in the fourth quarter down from a reported gain of $5,535 per loan in the third quarter, according to the Mortgage Bankers Association’s latest Quarterly Mortgage Bankers Performance Report.

MBA: IMB Production Profits Remain Strong in Fourth Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $3,738 on each loan they originated in the fourth quarter down from a reported gain of $5,535 per loan in the third quarter, according to the Mortgage Bankers Association’s latest Quarterly Mortgage Bankers Performance Report.

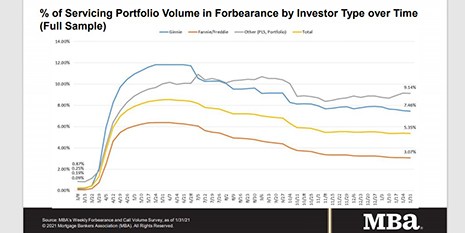

MBA: Loans in Forbearance Fall to 5.35%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.35% of servicers’ portfolio volume as of Jan. 31 compared to 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.