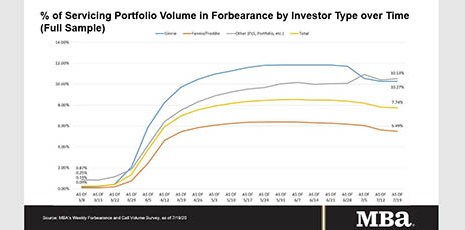

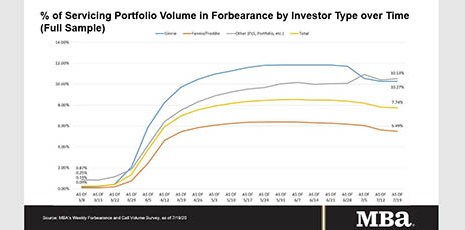

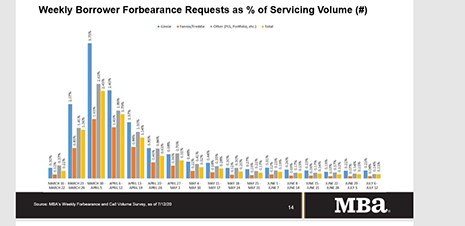

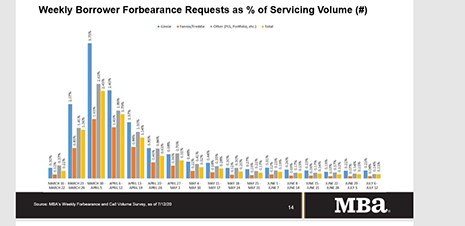

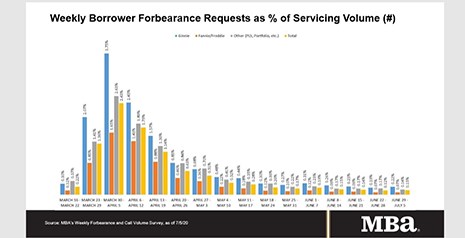

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

Tag: Independent Mortgage Banks

MBA Seeks Collaboration with CSBS on Remote Work Flexibility for State Licensees

The Mortgage Bankers Association asked the Conference of State Bank Supervisors to collaborate in addressing the real estate finance industry’s near-term issues related to work-from-home orders, and to build a longer-term framework for remote work capabilities to address future health emergencies, natural disasters and changing attitudes toward telework in today’s economy.

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

MBA Seeks Collaboration with CSBS on Remote Work Flexibility for State Licensees

The Mortgage Bankers Association asked the Conference of State Bank Supervisors to collaborate in addressing the real estate finance industry’s near-term issues related to work-from-home orders, and to build a longer-term framework for remote work capabilities to address future health emergencies, natural disasters and changing attitudes toward telework in today’s economy.

MBA: Share of Loans in Forbearance Falls for 6th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 7.74% of servicers’ volume as of July 19, from 7.80% the prior week. MBA now estimates 3.9 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Falls for Fifth Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 38 basis points to 7.80% of mortgage servicers’ portfolio volume as of July 12, from 8.18% the prior week. MBA estimates 3.9 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.

MBA: Share of Loans in Forbearance Falls 4th Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 21 basis points to 8.18% of servicers’ portfolio volume for the week of July 5, from 8.39% the week before. MBA now estimates 4.1 million homeowners are in forbearance plans, down from 4.2 million the previous week.