AMELIA ISLAND, Fla.–How can IMBs retain customers and become more profitable? Senior executives from Freedom Mortgage Corp. and Longbridge Financial addressed those questions here at the Mortgage Bankers Association’s Independent Mortgage Bankers conference.

Tag: Independent Mortgage Banks

MBA: IMBs Report Production Profits in Third Quarter

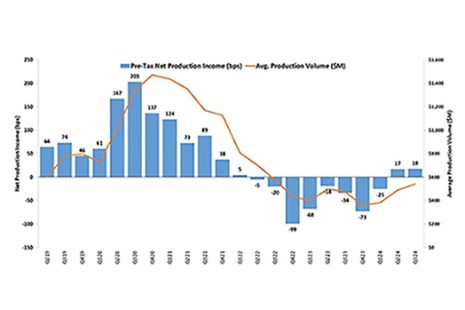

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net production profit of $1,201 on each loan they originated in the third quarter, according to MBA’s Quarterly Mortgage Bankers Performance Report.

MBA: IMB Production Profits Increase in Third Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net profit of $701 on each loan they originated in the third quarter, an increase from the reported net profit of $693 per loan in the second quarter, according to the Mortgage Bankers Association’s new Quarterly Mortgage Bankers Performance Report.

MBA: IMBs Post Net Production Profit for First Time in Two Years

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net profit of $693 on each loan they originated in the second quarter, an increase from the reported loss of $645 per loan in the first quarter, according to the Mortgage Bankers Association’s new Quarterly Mortgage Bankers Performance Report.

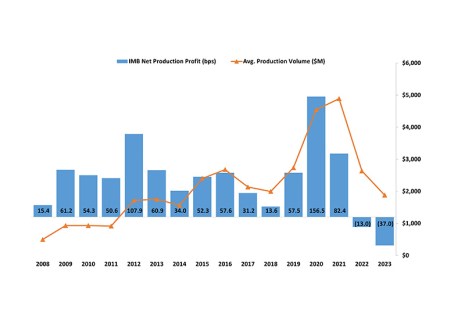

MBA: IMB Production Losses Reach Series High in 2023

Independent mortgage banks and mortgage subsidiaries of chartered banks lost an average of $1,056 on each loan they originated in 2023, down from an average loss of $301 per loan in 2023. This represents a series high in the 15-year history of the MBA Annual Mortgage Bankers Performance Report.

Broeksmit Discusses Recent Wins, Current Challenges: #MBAIMB24

NEW ORLEANS–In the face of a difficult business climate, the Mortgage Bankers Association is fighting for Independent Mortgage Bankers every day to ensure they can deliver for borrowers, MBA President and CEO Robert Broeksmit, CMB, said here at MBA’s Independent Mortgage Bankers conference.

LoanLogics’ Roby Robertson: Revolutionizing Mortgage Banks–A Smarter Approach to Staffing with Business Outcome Automation

Balancing staffing levels with the ebb and flow of interest rate fluctuations poses an ongoing challenge for independent mortgage banks (IMBs).

Designed by IMBs for IMBs: MBA Independent Mortgage Bankers Conference Starts Jan. 22

Join MBA in New Orleans for a conference held by independent mortgage bankers for independent mortgage bankers, where IMBs give direct input on all conference content.

To the Point With Bob: Thoughts Ahead of #MBAIMB24–Consumers Benefit From Large, Diverse Collection of Mortgage Lenders

MBA President and CEO Bob Broeksmit, CMB, shares his thoughts on topics related to IMBs ahead of #MBAIMB24.

Brian Webster From NotaryCam: Transforming Home Equity Lending–Why Mortgage Lenders Should Embrace eClosings

Home equity lending is back. According to the Mortgage Bankers Association’s Home Equity Lending Study, originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased by 50% in 2022 compared to 2020.