Builder confidence started the year lower as affordability concerns weigh heavily with buyers and builders contend with rising construction costs, the National Association of Home Builders/Wells Fargo Housing Market Index found.

Tag: Housing

Zillow Predicts Housing Market Will Warm in 2026

Zillow, Seattle, released a new forecast, predicting 2026 will see an increase in both home sales and values.

Sen. Elizabeth Warren: ‘Nothing Gets Better if We Don’t Build More Housing’

Sen. Elizabeth Warren took to the stage during MBA’s National Advocacy Conference April 8, emphasizing the challenges of the housing industry in the U.S. and advocating for bipartisan work and creativity in solving those impediments.

Fitch: Solid Demand, Home Price Growth Will Continue to Boost U.S. Housing Economy

The U.S. residential housing economy, which represents about 17% of GDP, will likely continue growing in second-half 2024 despite unaffordability due to high home prices and mortgage rates, according to Fitch Ratings, Chicago/New York.

Fitch: Heightened Risk of ‘Severe’ U.S. Housing Downturn in 2023

Fitch Ratings, New York, said it expects the housing market to weaken further in 2023 as affordability issues, softening economic environment and low consumer confidence continue to erode demand.

#MBANAC21: Senators Outline Housing Priorities

Three members of the Senate Banking Committee visited the Mortgage Bankers Association’s National Advocacy Conference to talk about renewed interest in housing priorities in the 117th Congress.

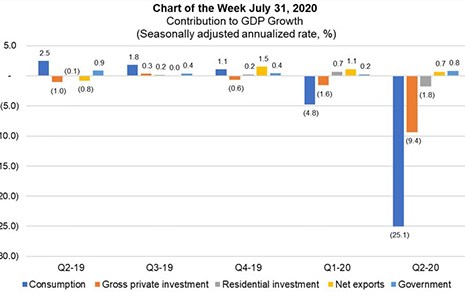

MBA Chart of the Week: Contribution to GDP Growth

This week’s MBA Chart of the Week drills down on the U.S. Bureau of Economic Analysis’ advance estimate of real gross domestic product for the second quarter, which was released July 30.

#MBAServicing2020: For Servicing Industry, A Cautious Economic Outlook

ORLANDO—Low mortgage rates, improved home-building rates and a growing number of people aspiring to homeownership makes for an optimistic formula for the mortgage servicing industry, said Mortgage Bankers Association economists, despite some potential headwinds in the short term.

#MBAServicing2020: For Servicing Industry, A Cautious Economic Outlook

ORLANDO—Low mortgage rates, improved home-building rates and a growing number of people aspiring to homeownership makes for an optimistic formula for the mortgage servicing industry, said Mortgage Bankers Association economists, despite some potential headwinds in the short term.

#MBAIMB20: Mortgage Market Outlook for IMBs

NEW ORLEANS—Last year at the Mortgage Bankers Association’s Independent Mortgage Bankers Conference, the outlook for the economy and IMBs seemed a bit bleaker. “We thought we were going to be chased off the stage,” quipped MBA Vice President of Industry Analysis Marina Walsh.