Christopher Exler is Senior Vice President with JLL’s Miami Hotel and Hospitality team, responsible for shaping and executing disposal and origination strategies. He specializes in maintaining investor relationships, monitoring international capital flows, investment advisory and managing the marketing and due diligence process.

Tag: Hotel Sector

DBRS: Hotel Pandemic Distress Less Than Prior Downturns

COVID-19 hit the hotel sector hard. DBRS Morningstar, Toronto, reported hotels had the highest loan modification rate among major property sectors due to the pandemic but said liquidations were lower than prior downturns.

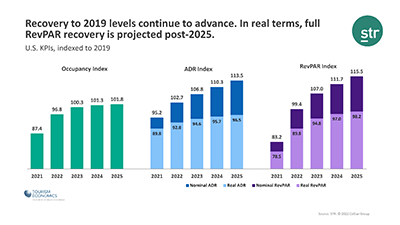

Analysts Upgrade U.S. Hotel Forecast

Underpinned by continued average daily rate improvement, analysts from STR and Tourism Economics slightly upgraded their U.S. hotel sector forecast.

Omicron Wave Weakens Hotel Revenue Recovery

Fitch Ratings, New York, said the global spread of the Omicron variant and new travel restrictions weaken the recovery prospects for hotel revenue per available room.

Hotel Performance Improving, But COVID-Variant Threat Persists

CBRE, Dallas, said average daily rate gains and a 35 percent year-over-year occupancy increase showed demand for U.S. hotels endured in Q3 despite the Delta variant.

Analysts Lift 2021 Hotel Forecast, Lessen 2022 Growth Projections

STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa., upgraded their U.S. hotel sector forecast for 2021 but lowered their growth projections for 2022.

Hotel Recovery Hits Plateau

The hotel sector’s recovery continues, though it has “plateaued” for the moment, analysts with STR and Trepp LLC reported.

Hotel Debt Markets Improving

The hospitality debt market is showing a resurgence as the lodging industry continues to recover, said JLL, Chicago.

Hotel Profitability Improves Slightly

U.S. hotel gross operating profit per available room improved slightly from prior months in January, but remains in the low single digits, reported STR, Hendersonville, Tenn.

Hotels Lenders, Investors Express Growing Optimism

After a difficult 2020 for the hotel sector, some hospitality lenders and investors are expressing optimism about 2021.