Analysts Upgrade U.S. Hotel Forecast

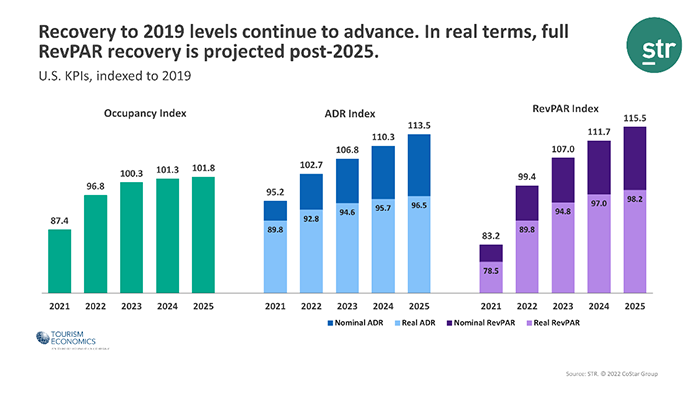

Underpinned by continued average daily rate improvement, analysts from STR and Tourism Economics slightly upgraded their U.S. hotel sector forecast.

Carter Wilson, STR Senior Vice President of Consulting, said hotels recaptured 83 percent of pre-pandemic revenue per available room levels last year, “and momentum is expected to pick up after a slow start to this year,” he said.

STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa., said ADR should surpass its pre-pandemic comparable this year on a nominal basis and RevPAR and occupancy are anticipated to exceed 2019 levels next year.

Many hotel owners have had to raise room rates to minimize the bottom-line hit from labor and supply shortages, Wilson noted. “We are anticipating inflation to remain higher throughout the first half of the year with a gradual leveling off during the third and fourth quarters,” he said. “If that happens and we avoid major setbacks with the pandemic this year will certainly be one to watch with demand and occupancy also shaping up to hit significant levels during the second half.”

Tourism Economics Director Aran Ryan called the backdrop for sustained travel recovery strong starting in the second quarter. “As the public health situation improves, sturdy labor market fundamentals, healthy consumer balance sheets and continued business investment are anticipated to support further lodging demand growth and pricing gains,” he said.

Lodging Econometrics, Portsmouth, N.H., reported the U.S. hotel construction pipeline stood at 4,814 projects with 581,953 rooms at year’s end, down 8 percent by projects and 10 by rooms year-over-year. “But while projects and rooms under construction have dipped slightly, the number of projects in the early planning stage continues to rise,” the firm’s Hotel Construction Pipeline report said. In late 2021, properties in the early planning stage saw an 18 percent jump by projects and 11 percent increase by rooms year-over-year to a total of 2,021 projects with 239,816 rooms in early plans.

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter. Projects under construction finished the year at 972 projects/131,247 rooms. New project announcements are down in the fourth quarter; however,

“Developers are eager to accelerate projects long delayed by the COVID-19 pandemic,” Lodging Econometrics said. “Unfortunately, they face some development roadblocks including escalating inflation and supply chain shortages that are causing higher prices versus pre-pandemic costs for labor and materials. These factors continue to prolong hotel development timelines.”

These challenges will likely abate throughout the year and construction starts should moderately improve as 2022 progresses, Lodging Econometrics said.