Price drops have become a common feature of the cooling housing market, particularly in places that were popular with homebuyers earlier in the pandemic, reported Redfin, Seattle.

Tag: Home Prices

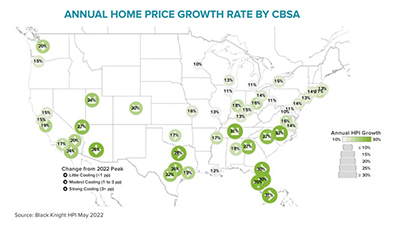

Black Knight: Signs of Home Price Cooling as Inventory Levels Improve

Black Knight, Jacksonville, Fla., said home price growth slowed in 97 of the 100 largest U.S. housing markets in May, with the national annual appreciation rate pulling back by more than a full percentage point from April.

A Summer Housing Market Cooldown?

Reports from House Canary, Washington, D.C., and Redfin, Seattle, point to slowing housing market activity this summer following a breakneck pace over the past two years.

Michael Rappaport of Homespire Mortgage: Prevailing Winds–3 Predictions for the Year Ahead

Based on current data and trends, here are three predictions for the industry’s landscape as we move further into 2022.

Nearly 6,000 Homes Sell for $100,000 Above Asking Price So Far in 2022

Redfin, Seattle, said low housing inventories, rising mortgage rates and double-digit home price increases have homebuyers willing to pay up—and up and up.

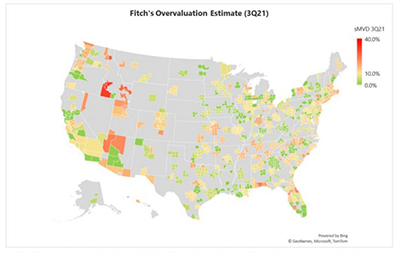

Home Price Appreciation Marches On, Unabated

Reports from Fitch Ratings, New York, and Redfin, Seattle, confirm other industry reports showing while U.S. home price growth appears to be slowing, market conditions portend a very competitive housing environment in 2022.

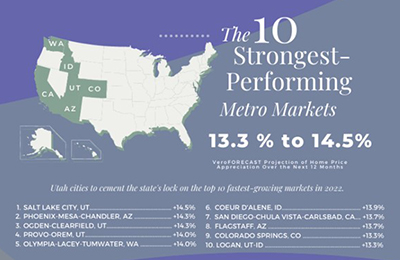

Veros: Slightly Slower Home-Price Growth, Still-Booming Market in 2022

Veros Estate Solutions, Santa Ana, Calif., released its Q4 2021 VeroFORECAST data, projecting home prices will appreciate on average 6.8% for the next 12 months—slightly less anticipated growth compared to its third quarter predicted national average appreciation of 7%.

By the Numbers: 10 Housing Records Set in 2021

The coronavirus pandemic and the resulting surge in remote work have changed where, when, why and how people buy homes, reported Redfin, Seattle, resulting in nearly a dozen housing market records in the past year.

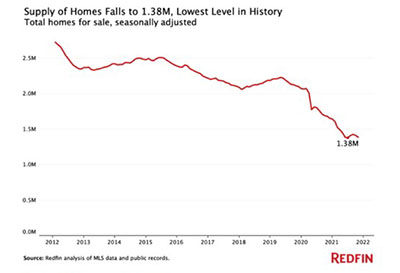

Zillow: Home Builders Still Playing Catchup

Zillow, Seattle, said limited supply of for-sale homes is a key reason home prices have risen quickly during the COVID-19 pandemic.

Housing Market Cools, But Relief for Homebuyers Short-Lived

Redfin, Seattle, said median home price appreciation slowed again in October, but provided little relief for homebuyers who have seen double-digit price increases over the past two years.