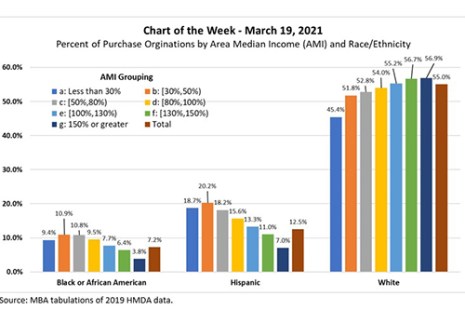

We analyzed the 2019 Home Mortgage Disclosure Act data for the 30 largest metropolitan statistical areas to understand the distributions of first lien mortgage purchase originations by Area Median Income and by race/ethnicity.

Tag: Home Mortgage Disclosure Act

MBA: 2019 Multifamily Lending Up 7% to Record High

Fueled by strong market fundamentals and low interest rates, 2,589 different multifamily lenders provided $364.4 billion in new mortgages in 2019 for apartment buildings with five or more units, according to the Mortgage Bankers Association’s annual multifamily lending market report.

CFPB Issues Interpretive Rule on Determining Underserved Areas; Final Rule on Loss Mitigation Options for Homeowners with COVID-Related Hardships

The Consumer Financial Protection Bureau yesterday issued an interpretive rule to provide guidance to creditors and other persons involved in the mortgage origination process about the way in which the Bureau determines which counties qualify as “underserved” for a given calendar year.

CFPB Issues Final Rule Raising HMDA Data Reporting Thresholds

The Consumer Financial Protection Bureau yesterday issued a final rule raising loan-volume coverage thresholds for financial institutions reporting data under the Home Mortgage Reporting Act.

CFPB Issues Final Rule Raising HMDA Data Reporting Thresholds

The Consumer Financial Protection Bureau this morning issued a final rule raising loan-volume coverage thresholds for financial institutions reporting data under the Home Mortgage Reporting Act.

CFPB Relaxes Information Collection, Reporting During Pandemic

The Consumer Financial Protection Bureau said it is postponing some data collections from industry on Bureau-related rules to allow financial companies to work with customers in responding to the coronavirus pandemic.

CFPB Relaxes Information Collection, Reporting During Pandemic

The Consumer Financial Protection Bureau said it is postponing some data collections from industry on Bureau-related rules to allow financial companies to work with customers in responding to the coronavirus pandemic.

CoreLogic: With QM GSE ‘Patch’ Set to Expire, Impact Warrants Closer Investigation

In two blog posts this week, CoreLogic, Irvine, Calif., said expiration of the Consumer Financial Protection Bureau’s Qualified Mortgage “GSE Patch” has thus far resulted in little distinction in loan delinquencies in certain rate spread categories, but noted closer investigation is warranted.

CFPB’s Fall Regulatory Agenda: LO Comp, Industry Issues on Radar Screen

The Office of Management and Budget released its Fall Regulatory Agenda, and the Consumer Financial Protection Bureau indicated that changes to Mortgage Loan Originator compensation–a long time regulatory priority of the Mortgage Bankers Association–appears to be high on the radar screen.