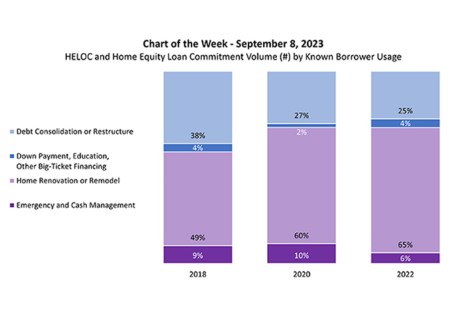

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

Tag: Home Equity Lines of Credit

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

Jim Leath of Equifax Mortgage Services: The Return of the HELOC Market

Customers now expect more from their HELOC lenders and are requesting a more personalized experience with high-touch digital online channels and mobile app experiences. However, with uncertainty around interest rates and continued inflation, HELOC borrowers are more likely than ever to choose to tap into their equity to remodel or upgrade their existing home rather than purchase a new one.

Dave Miller of Cenlar: Industry Outlook for Mortgage Servicing

More originators will look to partner with servicers that have the expertise to manage the regulatory and compliance requirements, which is undeniably the most critical factor to consider when choosing a servicer.

Jerry Schiano of Spring EQ: The Outlook for Home Equity Lending

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

Jerry Schiano of Spring EQ: The Outlook for Home Equity Lending

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

Jerry Schiano of Spring EQ: The Outlook for Home Equity Lending

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

Jerry Schiano of Spring EQ: The Outlook for Home Equity Lending

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.

Jerry Schiano of Spring EQ: The Outlook for Home Equity Lending

Jerry Schiano is CEO of Spring EQ, Philadelphia, a nationwide refinance, home equity and HELOC lender.