While traditionally dominated by depositories, independent mortgage bankers are now entering the Home Equity Lines of Credit market, marking a notable shift in the industry.

Tag: Home Equity Lending

Dovenmuehle’s Anna Krogh: When Unlocking the Potential of Home Equity, Understanding the Servicing Nuances is Key

While traditionally dominated by depositories, independent mortgage bankers are now entering the Home Equity Lines of Credit market, marking a notable shift in the industry.

Anna Krogh From Dovenmuehle: When Unlocking the Potential of Home Equity, Understanding the Servicing Nuances is Key

While traditionally dominated by depositories, independent mortgage bankers are now entering the Home Equity Lines of Credit market, marking a notable shift in the industry.

Brian Webster From NotaryCam: Transforming Home Equity Lending–Why Mortgage Lenders Should Embrace eClosings

Home equity lending is back. According to the Mortgage Bankers Association’s Home Equity Lending Study, originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased by 50% in 2022 compared to 2020.

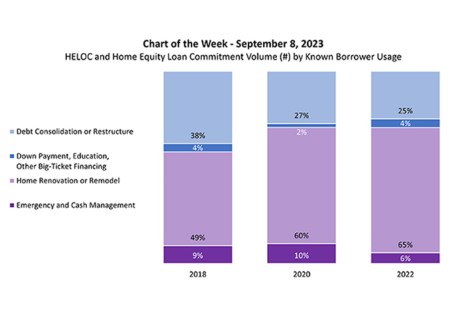

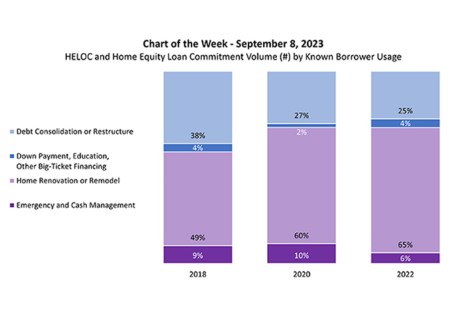

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

ATTOM: Mortgage Lending Up in Q2 From Q1

ATTOM, Irvine, Calif., reported the total number of mortgages secured by residential property rose from the first to second quarter, ending Q2 at 1.56 million.

MBA: Home Equity Lending Volume Rose in 2022 as Home Renovations Drive Demand

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased 50% in 2022 compared to two years earlier. This is according to the Mortgage Bankers Association’s Home Equity Lending Study, released for the first time since 2020.

MBA: Home Equity Lending Volume Rose in 2022 as Home Renovations Drive Demand

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased 50% in 2022 compared to two years earlier. This is according to the Mortgage Bankers Association’s Home Equity Lending Study, released for the first time since 2020.

Tavant’s Shannon Johnson on Rethinking HELOCs: Embracing Innovation in the Evolving Mortgage Industry

The mortgage industry has witnessed significant changes in recent years, challenging lenders and servicers to adapt to new market dynamics. As interest rates shifted, offering unique opportunities and posing new challenges, the home equity line of credit has emerged as a thought-provoking tool in the mortgage space.