MISMO, the real estate finance industry’s standards organization, announced the publication of the SMART Doc V3 eHELOC Specification.

Tag: HELOCs

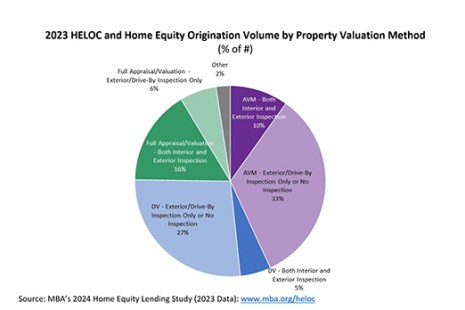

Chart of the Week: 2023 HELOC and Home Equity Origination Volume by Valuation Method

MBA recently completed its 2024 Home Equity Lending Study (covering 2023 data) tracking trends in origination and servicing operations for home equity lines of credit and home equity loans.

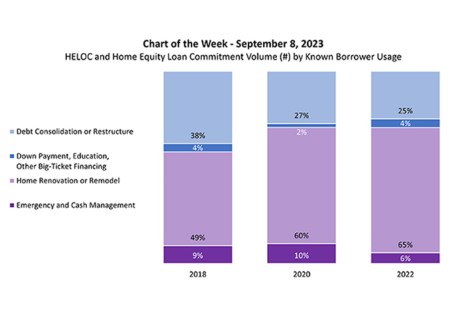

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

MBA Chart of the Week: HELOC and Home Equity Loan Commitment Volume

This week’s MBA Chart of the Week explores the known reasons that borrowers take out a HELOC or home equity loan.

Tavant’s Shannon Johnson on Rethinking HELOCs: Embracing Innovation in the Evolving Mortgage Industry

The mortgage industry has witnessed significant changes in recent years, challenging lenders and servicers to adapt to new market dynamics. As interest rates shifted, offering unique opportunities and posing new challenges, the home equity line of credit has emerged as a thought-provoking tool in the mortgage space.

Tavant’s Shannon Johnson on Rethinking HELOCs: Embracing Innovation in the Evolving Mortgage Industry

The mortgage industry has witnessed significant changes in recent years, challenging lenders and servicers to adapt to new market dynamics. As interest rates shifted, offering unique opportunities and posing new challenges, the home equity line of credit has emerged as a thought-provoking tool in the mortgage space.

Jim Leath of Equifax Mortgage Services: The Return of the HELOC Market

Jim Leath is senior vice president National Sales for Equifax Mortgage Services, Atlanta. He has more than 30 years of experience in the financial services and mortgage industries focusing on sales and business strategies.

Jim Leath of Equifax Mortgage Services: The Return of the HELOC Market

Customers now expect more from their HELOC lenders and are requesting a more personalized experience with high-touch digital online channels and mobile app experiences. However, with uncertainty around interest rates and continued inflation, HELOC borrowers are more likely than ever to choose to tap into their equity to remodel or upgrade their existing home rather than purchase a new one.

Jim Leath of Equifax Mortgage Services: The Return of the HELOC Market

Customers now expect more from their HELOC lenders and are requesting a more personalized experience with high-touch digital online channels and mobile app experiences. However, with uncertainty around interest rates and continued inflation, HELOC borrowers are more likely than ever to choose to tap into their equity to remodel or upgrade their existing home rather than purchase a new one.

Jim Leath of Equifax Mortgage Services: The Return of the HELOC Market

Customers now expect more from their HELOC lenders and are requesting a more personalized experience with high-touch digital online channels and mobile app experiences. However, with uncertainty around interest rates and continued inflation, HELOC borrowers are more likely than ever to choose to tap into their equity to remodel or upgrade their existing home rather than purchase a new one.