MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the resignation of Ginnie Mae President Alanna McCargo:

Tag: Ginnie Mae

Industry Briefs, March 15, 2024

Industry news from TitleEQ, Liquid Logics, Ginnie Mae, BSI Financial Services, Bizzy Labs and Informative Research.

Industry Briefs March 8, 2024

Industry news from Ginnie Mae, Fannie Mae, Mortgage Cadence, Talk’uments, FICO and Premier Lending.

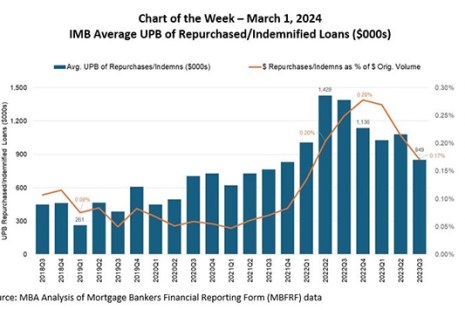

MBA Chart of the Week: IMB Average UPB of Repurchased/Indemnified Loans

MBA Research recently analyzed repurchase and indemnification volume over a five-year period from the third quarter of 2018 through the third quarter of 2023.

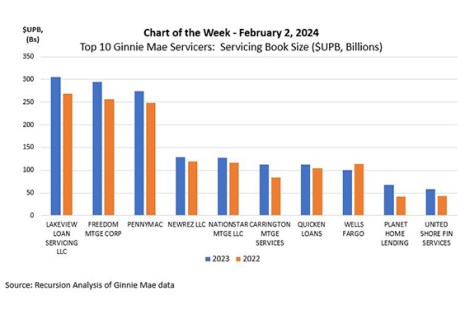

MBA Chart of the Week: Top 10 Ginnie Mae Servicers

This week’s MBA Chart of the Week highlights analysis by Recursion, a big data mortgage analytics firm, that ranks the 10 largest Ginnie servicers by servicing book size ($UPB).

Industry Briefs, Jan. 24, 2024

Industry news from Dark Matter, NRL Mortgage, Calque, Optimal Blue, Ncontracts, BluePoint Mortgage, OptifiNow and Ginnie Mae.

Industry Briefs, Jan. 23, 2024

Industry news from Dark Matter, NRL Mortgage, Calque, Optimal Blue, Ncontracts, BluePoint Mortgage, OptifiNow and Ginnie Mae.

Industry Briefs, Dec. 15, 2023

Industry news from Ginnie Mae, Incenter Capital Advisors, Grid151 and Avanze Tech Labs.

Industry Briefs Aug. 24, 2023

Industry briefs include a notice from federal agencies that aid for those affected by the Hawaii wildfires is ongoing, as well as releases from Asurity Partners, Cenlar and Firstline Compliance.

Industry Briefs Aug. 23, 2023

Industry briefs include a notice from federal agencies that aid for those affected by the Hawaii wildfires is ongoing, as well as releases from Asurity Partners, Cenlar and Firstline Compliance.