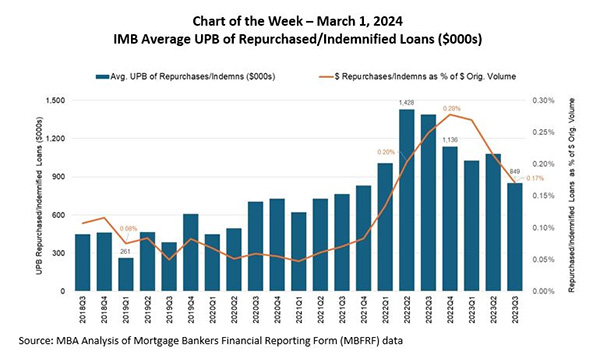

MBA Chart of the Week: IMB Average UPB of Repurchased/Indemnified Loans

MBA Research recently analyzed repurchase and indemnification volume over a five-year period from the third quarter of 2018 through the third quarter of 2023. Data was collected from approximately 500 independent mortgage companies through the Mortgage Bankers’ Financial Reporting Form, completed by Fannie and Freddie seller-servicers and Ginnie Mae issuers. For this Chart of the Week, the reported unpaid principal balance of loans repurchased or indemnified during each quarter was compared to the dollar volume of new loans originated each quarter.

The average unpaid balance (UPB) of repurchase and indemnification volume per company includes loans subject to standard representations and warranties, early payment default, first payment default, and other repurchase obligations. At its low point in the first quarter of 2019, the UPB averaged $261,000 per company, or 0.08% of new originations for that quarter. At its high point in the second quarter of 2022, the UPB averaged $1.4 million per company or 0.20% of the new originations for that quarter.

While repurchases and indemnifications began to drop in the second half of 2022, the percentage of repurchase volume to new originations rose further and reached 0.28% in the fourth quarter of 2022. This is because repurchases on volume originated in prior periods are being compared to current period origination volume that declined in 2022 and 2023. Despite this mismatch, it’s still the case that the percentage of repurchase volume to originations averaged 0.07% from 2018 through 2021 and has since averaged 0.22% in 2022 and 2023 – three times higher. The combination of more repurchases and less origination volume may exacerbate the financial and liquidity challenges for some independent mortgage companies.

– Marina Walsh, CMB (mwalsh@mba.org); Jenny Masoud (jmasoud@mba.org); June Wang (jwang@mba.org)