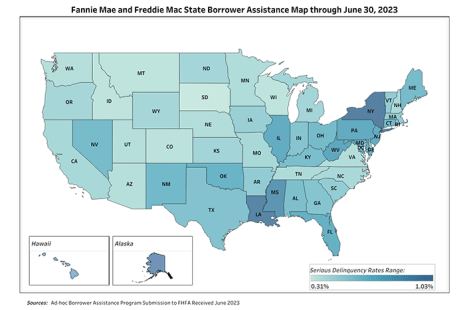

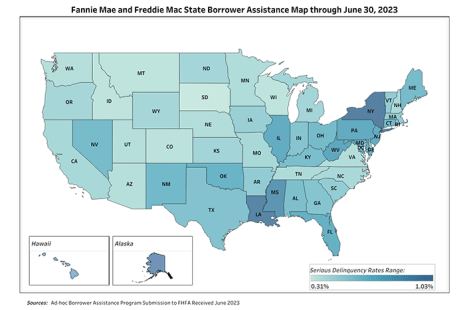

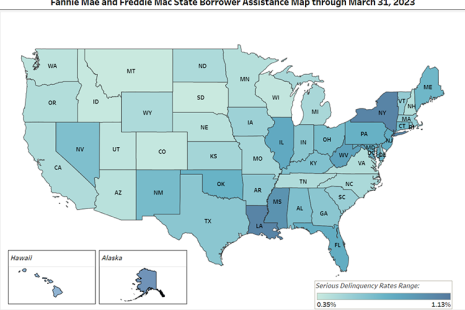

Fannie Mae and Freddie Mac completed 47,370 foreclosure prevention actions during the second quarter, raising the total number of homeowners helped to 6.8 million since the conservatorships started in 2008, the Federal Housing Finance Agency reported.

Tag: Freddie Mac

People in the News, Sept. 26, 2023

Freddie Mac CEO Michael DeVito announced he will retire from the post in the first quarter of 2024.

FHFA: GSEs Completed 47,370 Foreclosure Prevention Actions during Second Quarter

Fannie Mae and Freddie Mac completed 47,370 foreclosure prevention actions during the second quarter, raising the total number of homeowners helped to 6.8 million since the conservatorships started in 2008, the Federal Housing Finance Agency reported.

People in the News, Sept. 22, 2023

Freddie Mac CEO Michael DeVito announced he will retire from the post in the first quarter of 2024.

People in the News, Sept. 22, 2023

Freddie Mac CEO Michael DeVito announced he will retire from the post in the first quarter of 2024.

FHFA: GSEs Completed 47,370 Foreclosure Prevention Actions during Second Quarter

Fannie Mae and Freddie Mac completed 47,370 foreclosure prevention actions during the second quarter, raising the total number of homeowners helped to 6.8 million since the conservatorships started in 2008, the Federal Housing Finance Agency reported.

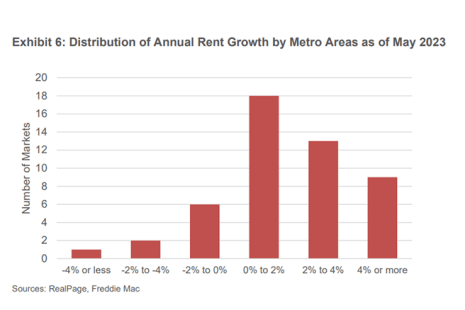

Freddie Mac: Multifamily Demand Returning Slowly in Uncertain Economic Climate

Freddie Mac, McLean, Va., projects the multifamily market will continue to stabilize but see below-average growth through the rest of the year.

Freddie Mac: Multifamily Demand Returning Slowly in Uncertain Economic Climate

Freddie Mac, McLean, Va., projects the multifamily market will continue to stabilize but see below-average growth through the rest of the year.

Fannie Mae, Redfin Find Home Prices Are Up

Fannie Mae in its Home Price Index found single-family home prices were up 3% in the second quarter from the same period in 2022.

FHFA: More Than 6.7M Troubled Homeowners Helped During Conservatorships

Fannie Mae and Freddie Mac completed 58,268 foreclosure prevention actions in the first quarter, the Federal Housing Finance Agency reported Friday.