The Federal Housing Finance Agency yesterday published a Credit Risk Transfer spreadsheet tool based on the re-proposed capital rule for Fannie Mae and Freddie Mac.

Tag: Freddie Mac

Industry Briefs June 3, 2020

The Federal Housing Finance Agency released its latest report on the sale of non-performing loans by Fannie Mae and Freddie Mac. The report shows that, through December 31, 2019, the Enterprises sold 126,757 NPLs with a total unpaid principal balance of $23.8 billion.

Dealmaker: Greystone Closes $106M for Multifamily Properties

Greystone, New York, closed an $86.2 million 10-year refinancing of Aspire Apartments in Tracy, Calif.

Dealmaker: Walker & Dunlop Secures $54M for Multifamily

Walker & Dunlop, Bethesda, Md., secured $54.3 million for multifamily assets in Washington, D.C. and Gainesville, Ga.

California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

FHFA Announces New Fannie Mae, Freddie Mac LIBOR Transition Resources

The Federal Housing Finance Agency yesterday announced Fannie Mae and Freddie Mac launched new websites that provide resources for lenders and investors as they transition away from the London Interbank Offered Rate.

California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

To the Point with Bob: FHFA’s Capital Rule and How it Fits into Housing Finance Reform

Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, in his newest blog, discusses latest developments involving the Federal Housing Finance Agency and its re-proposed capital framework for Fannie Mae and Freddie Mac.

Industry Briefs

Black Knight, Jacksonville, Fla., said its McDash Flash Forbearance Tracker, as of May 19, reported 4.75 million homeowners – or 9.0% of all mortgages – have entered into COVID-19 mortgage forbearance plans. Active forbearance volumes increased by just 93,000 over the past week, a more than 70% decline from the 325,000 from the first week of May.

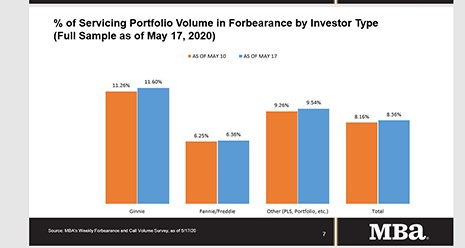

MBA: Share of Mortgage Loans in Forbearance Increases to 8.36%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance increased to 8.36% of mortgage servicer volume as of May 17, up from 8.16% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.