Commercial and multifamily mortgage delinquencies remained low at the end of the first quarter, the Mortgage Bankers Association said this morning in its first quarter Commercial/Multifamily Delinquency Report.

Tag: Freddie Mac

FHFA, FHA Extend Foreclosure/Eviction Moratorium to Aug. 31

The Federal Housing Finance Agency and HUD announced Fannie Mae, Freddie Mac and FHA will extend their single-family moratorium on foreclosures and evictions until at least August 31.

MBA: 1Q Commercial, Multifamily Mortgage Delinquencies Remain Low

Commercial and multifamily mortgage delinquencies remained low at the end of the first quarter, the Mortgage Bankers Association said this morning in its first quarter Commercial/Multifamily Delinquency Report.

Industry Briefs June 16, 2020

To help limited English proficiency borrowers who are experiencing mortgage-related difficulties due to the coronavirus national emergency, the Federal Housing Finance Agency added new translations to the Mortgage Translations website. Site visitors can now choose English, Spanish, traditional Chinese, Vietnamese, Korean, or Tagalog when accessing scripts that servicers use when discussing COVID-19 forbearance with borrowers.

Dealmaker: JLL Arranges $368M for Office, Multifamily

JLL Capital Markets, Chicago, arranged $367.6 million to refinance a four-building office campus and five multifamily properties.

FHFA to Re-Propose Updated Minimum Financial Eligibility Requirements for GSE Sellers/Servicers

The Federal Housing Finance Agency, citing “recent market events,” announced it will re-propose updated minimum financial eligibility requirements for Fannie Mae and Freddie Mac Seller/Servicers.

Dealmaker: Hunt Real Estate Capital Provides $67M In Fannie Mae, Freddie Mac Funds

Hunt Real Estate Capital, New York, provided $67 million in Fannie Mae and Freddie Mac funds for four apartment properties in the southeastern U.S. Hunt closed three Fannie Mae multifamily …

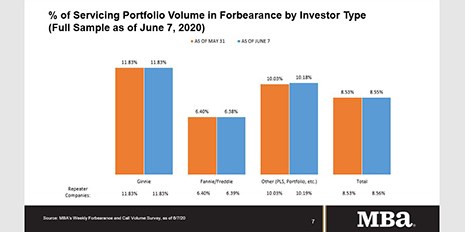

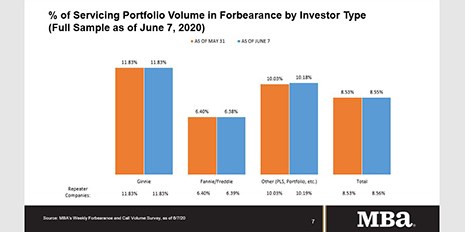

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

Industry Briefs

Stewart Information Services Corp., Houston, acquired United States Appraisals. Stewart said the acquisition strengthens its digital real estate services offering in appraisal and valuation management and enhances its existing title insurance, settlement services, appraisal/valuation and other real estate services.