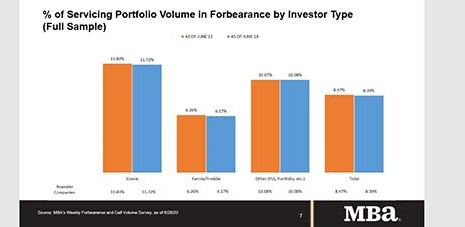

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

Tag: Freddie Mac

MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency on Monday announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

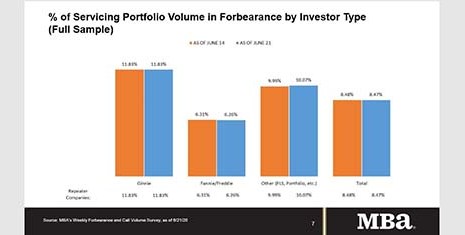

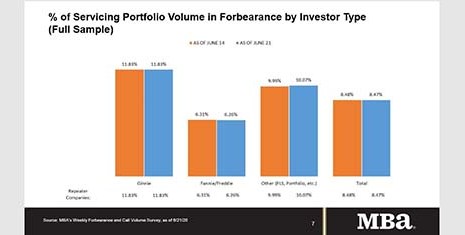

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Dips to 8.47%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 8.47%of servicers’ portfolio volume as of June 21, a slight decrease from 8.48% the week before. MBA now estimates 4.2 million homeowners are in forbearance plans.

Industry Briefs June 30, 2020

Roostify, San Francisco, announced a partnership with Factual Data as part of an expansion that will allow loan officers to run borrower credit and view findings within the Roostify platform.

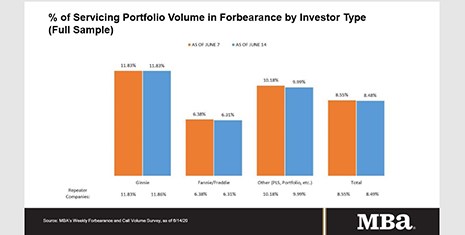

MBA: Shares of Loans in Forbearance Falls to 8.48%

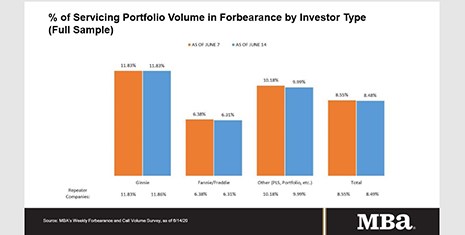

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

MBA: Share of Mortgage Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.

Industry Briefs June 23, 2020

Black Knight, Jacksonville, Fla., said homeowners in active forbearance fell again last week. Overall, the number of active forbearance plans is down 57,000 from the previous week and 158,000 from the peak the week of May 22.