The Federal Housing Finance Agency on Thursday announced Fannie Mae and Freddie Mac would extend several loan origination flexibilities until January 31, from Dec. 31.

Tag: Freddie Mac

The Redesigned URLA Is Coming Jan. 1. Are You Ready?

Fannie Mae and Freddie Mac (the GSEs) will ring in the New Year by starting to accept the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting system (AUS) loan application submission files based on MISMO v3.4.

The Redesigned URLA Is Coming Jan. 1. Are You Ready?

Fannie Mae and Freddie Mac (the GSEs) will ring in the New Year by starting to accept the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting system (AUS) loan application submission files based on MISMO v3.4.

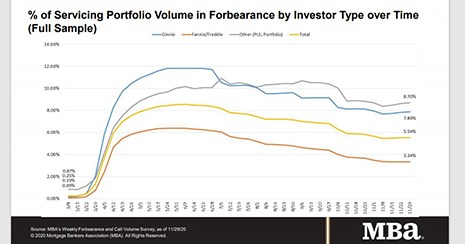

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Flat at 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged from the prior week at 5.54% as of November 29. MBA estimates 2.8 million homeowners are in forbearance plans.

FHFA Extends Foreclosure and REO Eviction Moratoria through Jan. 31

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will extend the moratoriums on single-family foreclosures and real estate owned (REO) evictions until at least January 31, 2021.

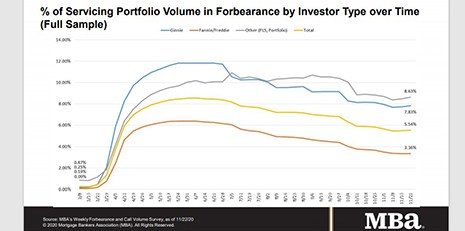

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases to 5.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.54% of servicers’ portfolio volume as of November 22, 2020 from 5.48% the prior week. MBA estimates 2.8 million homeowners are in forbearance plans.

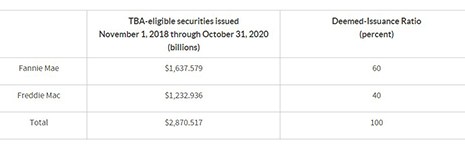

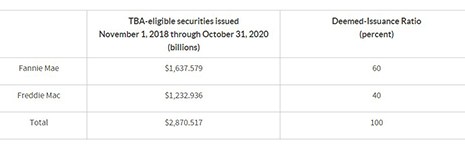

FHFA Holds 2021 Deemed-Issuance Ratio for UMBS at 60/40

The Federal Housing Finance Agency announced the deemed-issuance ratio for the 2021 calendar year in accordance with Internal Revenue Service guidelines on trading of the Uniform Mortgage-Backed Security will remain unchanged in 2021 at 60 percent Fannie Mae and 40 percent Freddie Mac.

FHFA Holds 2021 Deemed-Issuance Ratio for UMBS at 60/40

The Federal Housing Finance Agency announced the deemed-issuance ratio for the 2021 calendar year in accordance with Internal Revenue Service guidelines on trading of the Uniform Mortgage-Backed Security will remain unchanged in 2021 at 60 percent Fannie Mae and 40 percent Freddie Mac.