The Federal Housing Finance Agency, Washington, D.C., announced yesterday Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners through March 31, 2021.

Tag: Freddie Mac

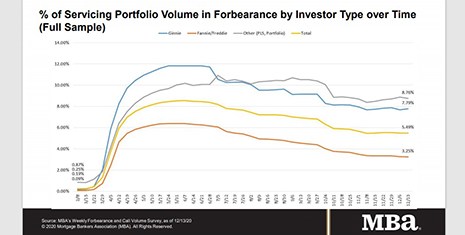

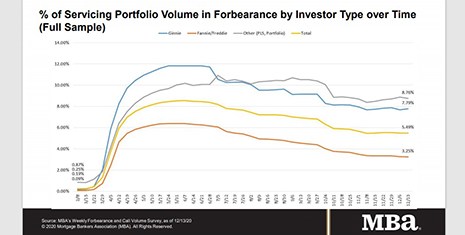

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

The Redesigned URLA Mandate Is Around the Corner. Will Your Technology Solution Be Ready?

December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.

FHFA: GSEs Complete 539,000 3Q Foreclosure Prevention Actions

The Federal Housing Finance Agency released its third quarter 2020 Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 539,451 foreclosure prevention actions in quarter, bringing to 5.2 million the number of troubled homeowners who have been helped during conservatorships.

The Redesigned URLA Mandate Is Around the Corner. Will Your Technology Solution Be Ready?

December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.

FHFA Issues Proposed Rulemaking for Enterprise Liquidity Requirements, Seeks Comments

The Federal Housing Finance Agency, Washington, D.C., announced it would like comments on a proposed rulemaking regarding Fannie Mae and Freddie Mac liquidity requirements.

The Redesigned URLA Mandate Is Around the Corner. Will Your Technology Solution Be Ready?

December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.

FHFA Holds GSE Affordable Housing Goals Steady

The Federal Housing Finance Agency yesterday announced its 2021 affordable housing goals for Fannie Mae and Freddie Mac will remain the same as they were in 2020. It also seeks input about future housing goals rulemaking.

The Redesigned URLA Mandate Is Around the Corner. Will Your Technology Solution Be Ready?

December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.