The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will extend several loan origination flexibilities until February 28. The changes are to ensure continued support for borrowers during the COVID-19 national emergency. The flexibilities were set to expire on January 31.

Tag: Freddie Mac

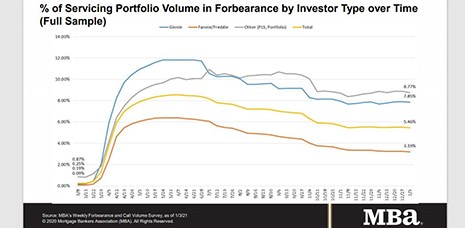

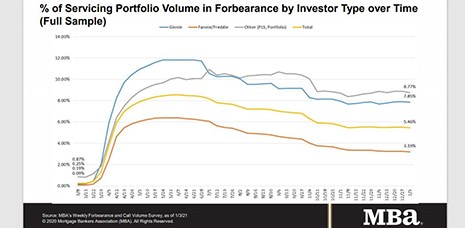

MBA: Share of Loans in Forbearance Drops to 5.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.46% of servicers’ portfolio volume as of Jan. 3 compared to 5.46% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Drops to 5.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.46% of servicers’ portfolio volume as of Jan. 3 compared to 5.46% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Industry Briefs Jan. 12, 2021

Verus Commercial Real Estate Finance, New York, launched a new product for financing of Single-Family Home Rental Portfolios.

Dealmaker: Berkadia Secures $107M for Florida, California Multifamily

Berkadia arranged $106.9 million in agency financing for apartment communities in Tampa, Fla. and Laguna Niguel, Calif.

FHFA Announces GSE ‘Duty to Serve’ 2021 Market Plans

The Federal Housing Finance Agency on Jan. 6 published the 2021 Underserved Markets Plans for Fannie Mae and Freddie Mac under the Duty to Serve program. The Plans became effective Jan. 1.

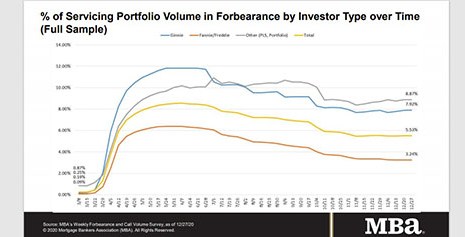

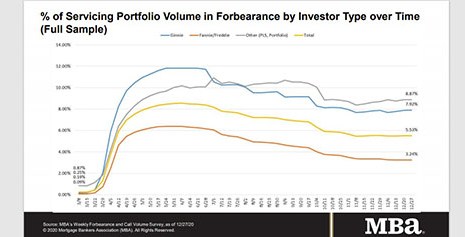

MBA: Share of Mortgage Loans in 2-Month Holding Pattern

The Mortgage Bankers Association’s Forbearance and Call Volume Survey showed little change over the holiday season–and in fact, has shown little change over the past two months.

MBA: Share of Mortgage Loans in 2-Month Holding Pattern

The Mortgage Bankers Association’s Forbearance and Call Volume Survey showed little change over the holiday season–and in fact, has shown little change over the past two months.

Industry Briefs, Jan. 5, 2021

Simon Property Group, Indianapolis, completed its acquisition of an 80 percent ownership interest in The Taubman Realty Group Limited Partnership, Bloomfield Hills, Mich.

FHFA Issues Proposed Rulemaking Notice on GSE Resolution Plans

The Federal Housing Finance Agency this week issued a Notice of Proposed Rulemaking that would require Fannie Mae and Freddie Mac to develop credible resolution plans, also known as living wills.