One year ago, almost no one could have predicted what 2020 would bring. Everyone in the real estate world had to adjust their expectations.

Tag: Freddie Mac

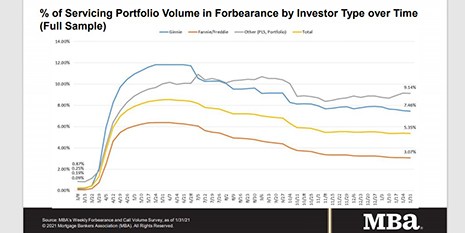

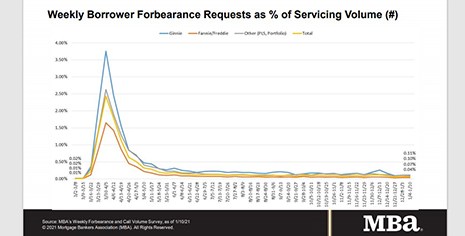

MBA: Loans in Forbearance Fall to 5.35%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.35% of servicers’ portfolio volume as of Jan. 31 compared to 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

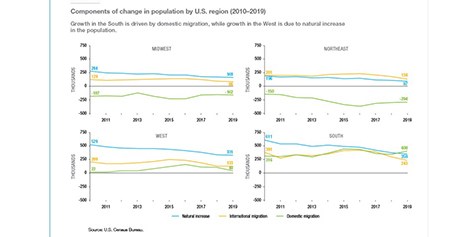

Freddie Mac: South, West Populations Growing 7X Faster than Rest of U.S.

Freddie Mac, McLean, Va., reported the U.S. population in the South and West grew seven times faster than in the Northeast and Midwest between 2017 and 2019.

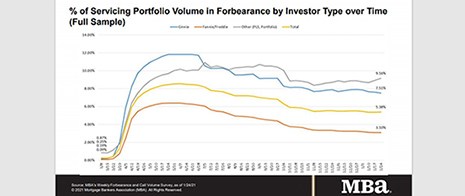

MBA: Share of Loans in Forbearance Unchanged at 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged at 5.38% of servicers’ portfolio volume as of January 24. MBA estimates 2.7 million homeowners are in forbearance plans.

Freddie Mac Projects Multifamily Origination Rebound Boosted by Smaller Markets

Freddie Mac, McLean, Va., projects overall multifamily origination volume will rebound, growing to $340 billion by year-end as the economy is boosted by another federal stimulus package.

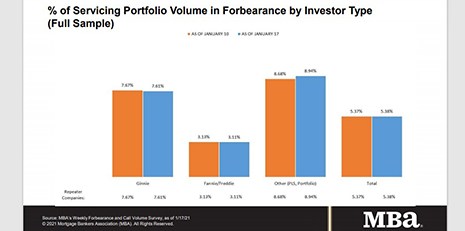

MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

Dealmaker: Capital One Closes Freddie Mac Loans Totaling $79M

Capital One, Bethesda, Md., provided Freddie Mac loans totaling $79.4 million to refinance 18 apartment communities in California and Georgia.

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.37%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance fell to 5.37% of servicers’ portfolio volume as of Jan. 10, compared to 5.46% the previous week. MBA estimates 2.7 million homeowners are in forbearance plans.

FHFA Amends GSE Stock Purchase Agreements; Leaves Decision on Conservatorship to Biden Administration

Fannie Mae and Freddie Mac will not exit federal conservatorship under the Trump Administration; the Federal Housing Finance Agency will leave that decision to the Biden Administration, FHFA said late yesterday.

FHFA Amends GSE Stock Purchase Agreements; Leaves Decision on Conservatorship to Biden Administration

Fannie Mae and Freddie Mac will not exit federal conservatorship under the Trump Administration; the Federal Housing Finance Agency will leave that decision to the Biden Administration, FHFA said late yesterday.