The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

Tag: Freddie Mac

Freddie Mac: Leverage Existing Rental Housing Stock

As states and localities seek to provide economic incentives to create new housing supply, they must also consider how to leverage the existing rental housing stock, said Freddie Mac, McLean, Va.

FHFA Finalizes 2022-2024 Single-Family, 2022 Multifamily Housing Goals

The Federal Housing Finance Agency released benchmark levels for Fannie Mae and Freddie Mac single-family housing goals for 2022 through 2024 and benchmark levels for multifamily housing goals for 2022.

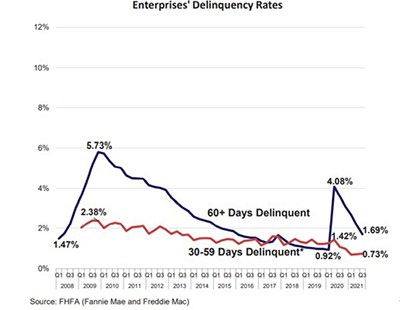

FHFA: GSE Delinquency Rate Falls to 1.55%

The Federal Housing Finance Agency released its third quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 180,566 foreclosure prevention actions during the quarter, raising the total number of homeowners who have been helped to 6,210,485 since the start of conservatorships in September 2008.

FHFA: Freddie Mac Fails 2020 Low-Income Refi Goal; GSE Guarantee Fees Fall

The Federal Housing Finance Agency announced final determinations for Fannie Mae/Freddie Mac performance on their 2020 housing goals, saying Freddie Mac failed to meet a key goal.

Industry Briefs Dec. 20, 2021: Clear Capital Launches ClearPhoto

Clear Capital, Reno, Nev., launched ClearPhoto, a set of AI-driven rules built into ClearCollateral Review, automating the review of property photos and ensuring they are aligned with the appraisal data and sketch.

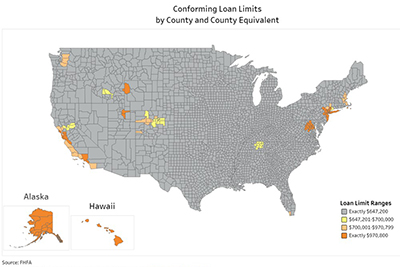

2022 GSE Conforming Loan Limits Rise 18.5% to $647,200

Conforming loan limits for Fannie Mae and Freddie Mac will rise to $647,200 jump in 2022, the Federal Housing Finance Agency said on Tuesday—a jump of nearly $100,000 from 2021’s previous record high.

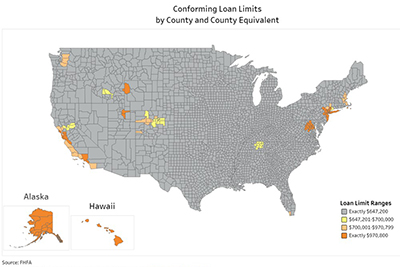

2022 GSE Conforming Loan Limits Rise 18.5% to $647,200

Conforming loan limits for Fannie Mae and Freddie Mac will rise to $647,200 jump in 2022, the Federal Housing Finance Agency said on Tuesday—a jump of nearly $100,000 from 2021’s previous record high.

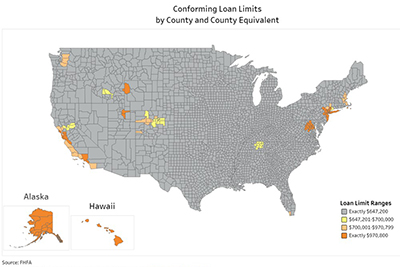

2022 GSE Conforming Loan Limits Rise 18.5% to $647,200

Conforming loan limits for Fannie Mae and Freddie Mac will rise to $647,200 jump in 2022, the Federal Housing Finance Agency said on Tuesday—a jump of nearly $100,000 from 2021’s previous record high.

MBA Letter Offers Recommendations to FHFA Proposed Regulatory Capital Framework

The Mortgage Bankers Association, in a Nov. 23 letter to the Federal Housing Finance Agency, offered a series of recommendations to improve a proposed regulatory capital framework rule for Fannie Mae and Freddie Mac.