HUD announced $28,625,000 available to fair housing organizations across the nation working to fight housing discrimination. The funds will support a variety of activities, including fair housing education and outreach, testing and enforcement, through the Department’s Fair Housing Initiatives Program.

Tag: Freddie Mac

FHFA: GSEs Complete 97,000 2nd Quarter Foreclosure Preventions

The Federal Housing Finance Agency released its second quarter Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 96,945 foreclosure prevention actions during the quarter, raising the total number of homeowners who have been helped to 6,591,002 since start of conservatorships in September 2008.

Industry Briefs Aug. 23, 2022: Vice Capital Markets Releases API for Freddie Mac Cash Purchase Statement

Vice Capital Markets, Novi, Mich., released an integration for Freddie Mac’s Cash Settlement Purchase Statement application programming interface.

FHFA, Ginnie Mae Update Capital, Liquidity, Net Worth Requirements for Seller/Servicers, Issuers

The Federal Housing Finance Agency and Ginnie Mae updated their minimum financial eligibility requirements for seller/servicers and issuers on Wednesday.

FHFA, Ginnie Mae Update Capital, Liquidity, Net Worth Requirements for Seller/Servicers, Issuers

The Federal Housing Finance Agency and Ginnie Mae updated their minimum financial eligibility requirements for seller/servicers and issuers on Wednesday.

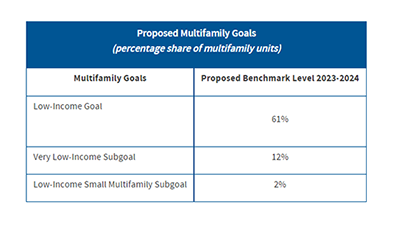

FHFA Proposes 2023-2024 Fannie Mae, Freddie Mac Multifamily Housing Goals

The Federal Housing Finance Agency on Tuesday proposed new benchmark levels for Fannie Mae and Freddie Mac multifamily housing goals in 2023 and 2024.

FHFA Announces Update for Services to Maintain Fair Lending Data

The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will require servicers to obtain and maintain fair lending data on their loans, and for this data to transfer with servicing throughout the mortgage term.

Industry Briefs Aug. 10, 2022: TransUnion Says Serious Delinquencies ‘Normalizing’ to Pre-Pandemic Levels

TransUnion, Chicago, said the first half of 2022 concluded with a normalization in serious delinquency rates to pre-pandemic levels for most credit products as lenders continued to expand access to credit cards and personal loans.

Industry Briefs Aug. 5, 2022: Fannie Mae Survey Cites Cost-Cutting as Top 2022 Business Priority

Fannie Mae, Washington, D.C., said mortgage lenders appear to be adapting their business priorities to meet what they believe are a new set of challenges, including weakened mortgage demand and rising rates.