The Federal Housing Finance Agency announced this afternoon that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.

Tag: Forbearance

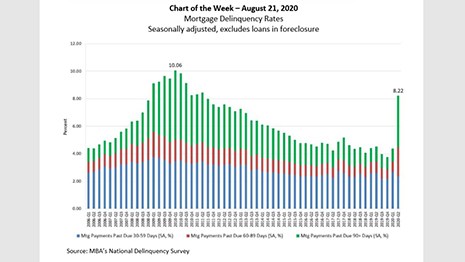

MBA Chart of the Week: Mortgage Delinquency Rates

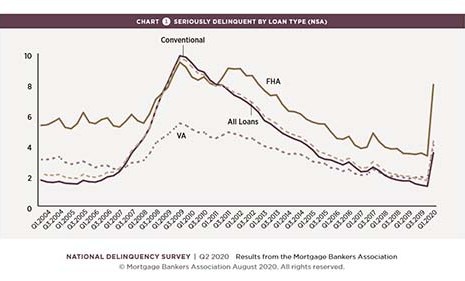

MBA released its National Delinquency Survey results for the second quarter last week. Key findings revealed that the COVID-19 pandemic’s effects on some homeowners’ ability to make their mortgage payments could not be more apparent.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

MBA: Mortgage Delinquencies Spike in Second Quarter

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

LIBOR: The Floodwaters are Rising

In late 2019, the international financial industry generally considered the United States to be leading the way on LIBOR transition efforts. Then COVID-19 turned the world upside down and many companies had to shift resources to respond.

Industry Briefs Aug. 7, 2020

News in brief from Black Knight, STRATMOR Group, Arvest Bank, SimpleNexus, Fiserv

FHFA: Multifamily Owners in Forbearance Must Inform Tenants of Eviction Suspension, Tenant Protections

The Federal Housing Finance Agency announced Thursday multifamily property owners with mortgages backed by Fannie Mae or Freddie Mac who enter into a forbearance agreement must inform their tenants about protections during the property owner’s forbearance and repayment periods.

MBA: Share of Mortgage Loans in Forbearance Decreases for Seventh Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans in forbearance decreased 7 basis points to 7.67% of servicers’ portfolio volume as of July 26 from 7.74% in the prior week.

MBA: Share of Mortgage Loans in Forbearance Decreases for Seventh Straight Week

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans in forbearance decreased 7 basis points to 7.67% of servicers’ portfolio volume as of July 26 from 7.74% in the prior week.