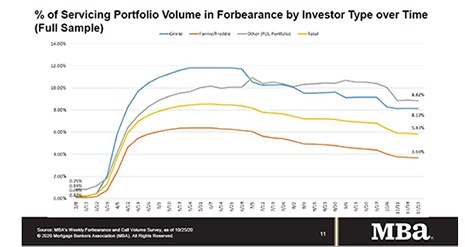

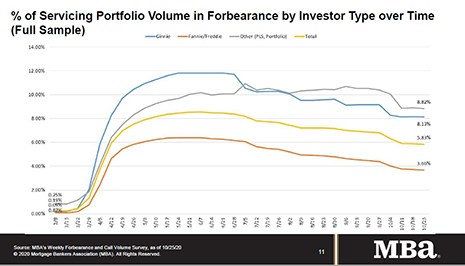

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020.

Tag: Forbearance

Share of Mortgage Loans in Forbearance Decreases to 5.83%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020.

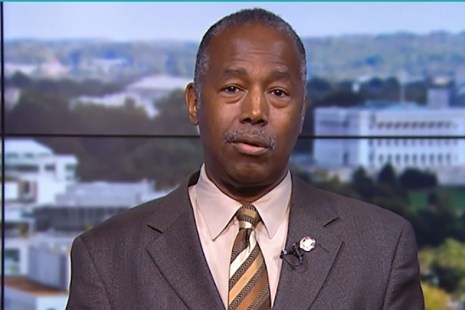

Carson: FHA Will Extend Forbearance Requests Through Year-End

HUD Secretary Ben Carson yesterday announced the Federal Housing Administration will extend the date for single-family homeowners with FHA-insured mortgages to request an initial forbearance from their mortgage servicer for up to six months.

FHA: GSEs Complete 252,000 2Q Foreclosure Preventions

The Federal Housing Finance Agency said Fannie Mae and Freddi Mac completed 252,014 foreclosure prevention actions in the second quarter, bringing to 4.68 million the number of troubled homeowners who have been helped during conservatorships.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

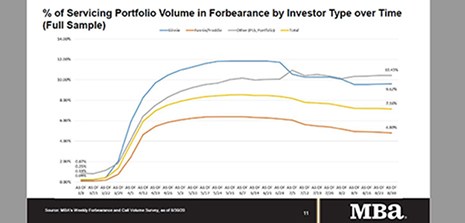

MBA: Share of Mortgage Loans in Forbearance Declines to 7.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance decreased 4 basis points to 7.16 percent of servicers’ portfolio volume as of Aug. 30.

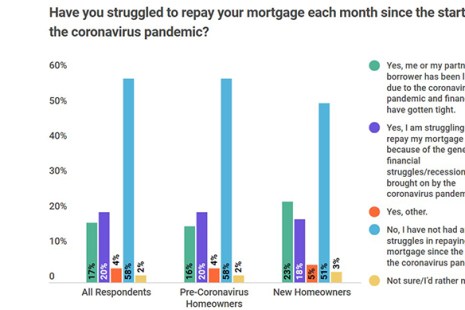

Regrets? For Some Homeowners During Pandemic, a Few

A new survey from LendEDU, Hoboken, N.J., finds more than half of new homeowners regret taking out a mortgage during the coronavirus pandemic, with most of them citing a job layoff as the reason for their angst.

FHFA Extends GSE Forbearance Purchases through Sept. 30; Extends COVID-Related Loan Processing Flexibilities

The Federal Housing Finance Agency announced Wednesday that Fannie Mae and Freddie Mac will extend buying qualified loans in forbearance and several loan origination flexibilities through September 30.