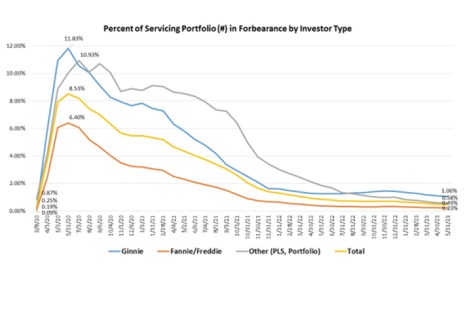

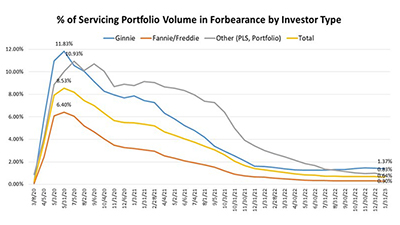

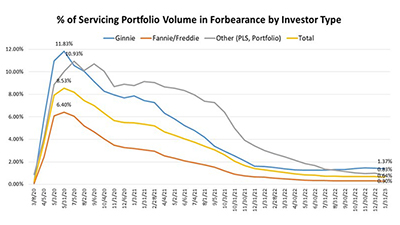

The total number of loans now in forbearance decreased to 0.49% for May from 0.51% of servicers’ portfolio volume in April, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

Tag: Forbearance

MBA Comments on HUD COVID-Related Loss Mitigation Report

The HUD Office of the Inspector General issued two audit reports Thursday examining the loss mitigation options that loan servicers provided to borrowers with FHA-insured loans after their COVID-19 forbearance ended.

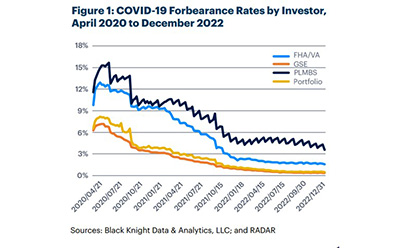

Philly Fed Report Declares Industry Victory on Forbearance

A report commissioned by the Federal Reserve Bank of Philadelphia found more than 95 percent of the estimated 8.5 million borrowers who entered forbearance have exited.

MBA: January Share of Mortgage Loans in Forbearance Decreases to 0.64%

Loans in forbearance decreased by 6 basis points in January to 0.64% of servicers’ portfolio volume as of January 31, the Mortgage Bankers Association reported Tuesday.

MBA: January Share of Mortgage Loans in Forbearance Decreases to 0.64%

Loans in forbearance decreased by 6 basis points in January to 0.64% of servicers’ portfolio volume as of January 31, the Mortgage Bankers Association reported Tuesday.

FHA Expands Assistance Options for Struggling Borrowers

The Federal Housing Administration on Monday announced expansion of its loss mitigation options used to help borrowers struggling to make mortgage payments on their FHA-insured mortgages.

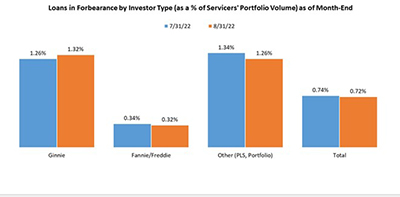

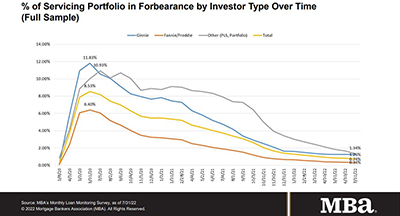

MBA: August Share of Mortgage Loans in Forbearance Falls to 0.72%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 2 basis points from 0.74% of servicers’ portfolio volume in the prior month to 0.72% as of August 31. MBA estimates 360,000 homeowners are in forbearance plans.

July Mortgage Loan Forbearance Rate Falls to 0.74%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 7 basis points to 0.74% of servicers’ portfolio volume as of July 31, from 0.81% in June. MBA estimates 370,000 homeowners remain in forbearance plans.

July Mortgage Loan Forbearance Rate Falls to 0.74%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 7 basis points to 0.74% of servicers’ portfolio volume as of July 31, from 0.81% in June. MBA estimates 370,000 homeowners remain in forbearance plans.

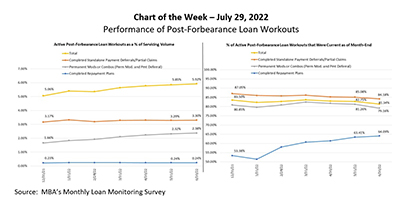

MBA Chart of the Week July 29, 2022: Performance of Post-Forbearance Loan Workouts

According to MBA’s Monthly Loan Monitoring Survey, the share of loans in forbearance dropped slightly to 0.81 percent of servicers’ portfolio volume as of June 30, 2022, from 0.85 percent the prior month.