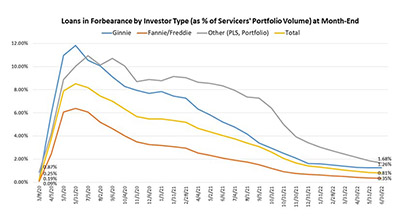

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 4 basis points from 0.85% of servicers’ portfolio volume in May to 0.81% on June 30.

Tag: Forbearance

MBA: Share of Mortgage Loans in Forbearance Drops to 1.30%

Loans in forbearance fell again in January to pre-pandemic lows, the Mortgage Bankers Association reported on Monday.

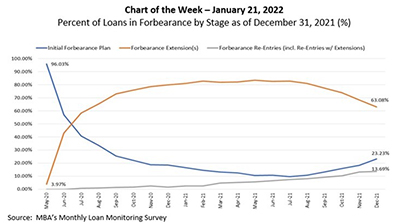

MBA Chart of the Week Jan. 21 2022: Loans in Forbearance

This week’s MBA Chart of the Week shows the percentage of all loans still in forbearance in our sample by stage

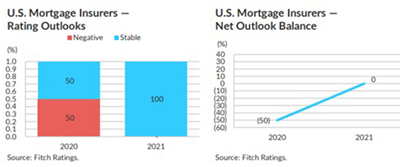

Fitch: Mortgage Insurers See Consistent Losses, Market Stability in 2022

Fitch Ratings, Chicago, said the operating environment for U.S. mortgage insurers is expected to remain steady in 2022, as economic indicators have generally improved since the low point of the pandemic, with lower than expected losses from the pandemic fallout and continued home price appreciation supportive of credit fundamentals of the rated peer group of private MIs.

Rida Sharaf: Ready…Set… Go! The Mortgage Industry’s Upcoming Obstacle Course

As yet another extension of the nationwide pandemic eviction and foreclosure restrictions is put in place (at least for federally back mortgages), the mortgage industry is bracing for formidable challenges on a number of fronts.

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said Monday.

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

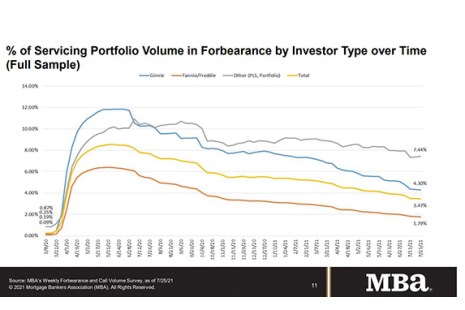

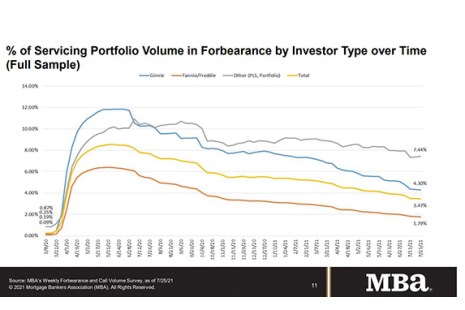

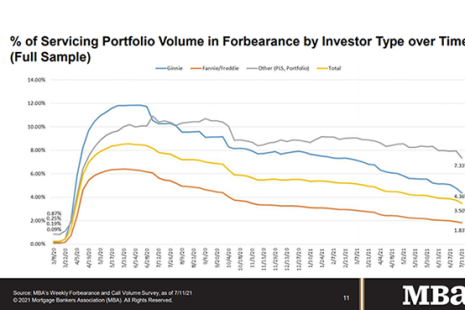

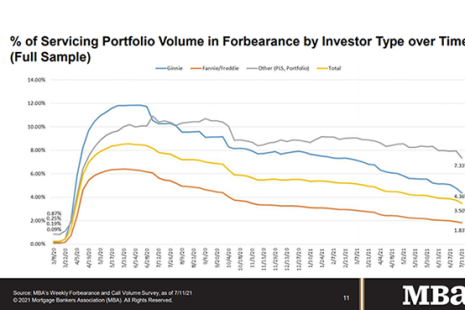

Share of Mortgage Loans in Forbearance Decreases to 3.50%

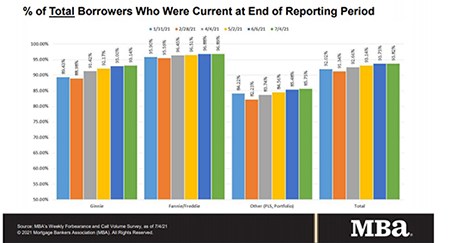

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 26 basis points to 3.50% of servicers’ portfolio volume as of July 11–the twentieth consecutive weekly decline.

Share of Mortgage Loans in Forbearance Decreases to 3.50%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 26 basis points to 3.50% of servicers’ portfolio volume as of July 11–the twentieth consecutive weekly decline.

Share of Mortgage Loans in Forbearance Decreases

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased